Keeping your feet dry

by Doug Brodie

/1. Top trusts for income.

I wonder how many people reading this realise that the decisions to be made on retirement money are all directing how the future will pan out, whereas all the data for those decisions are all historical? You can’t guess the future by you can analyse the past – it’s not a guarantee of a future outcome but it’s a much more rational decision-making process than tea leaves or chatting with Nigel down the Frog & Cat.

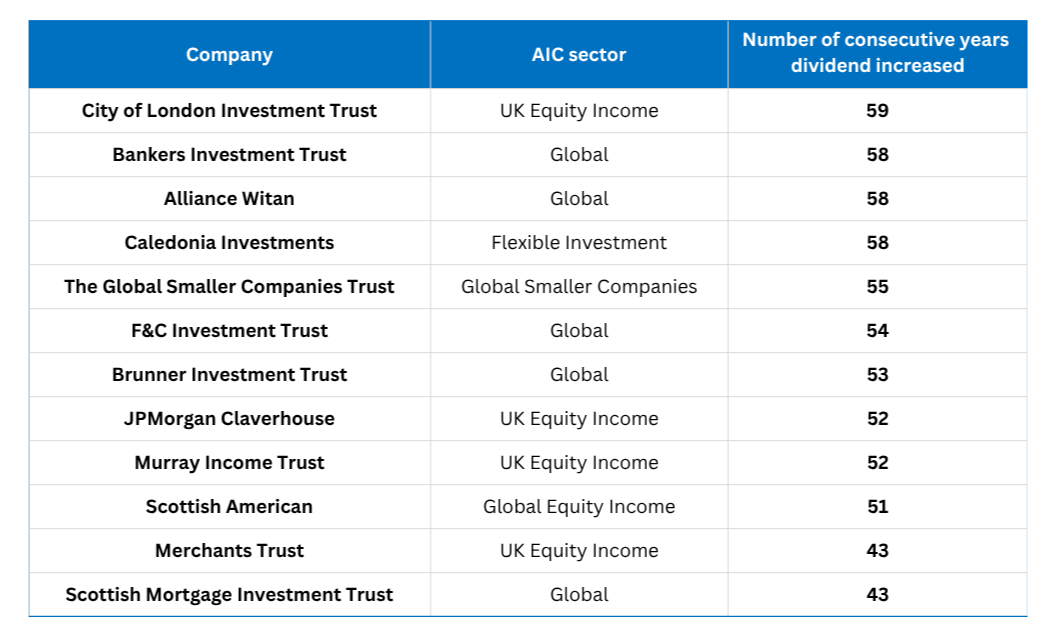

This is the Dividend Heroes table from the AIC:

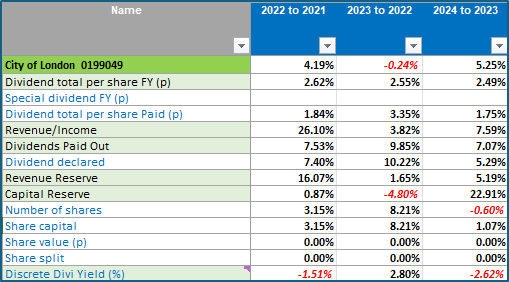

Like Dali’s early background, we do a little more groundwork, here’s a snip from one of the workbooks that we use, put together by our research team, taking an in depth look at City of London:

This is the percentage variance measured over the prior three years – our data actually goes all the way back for 38 years, to 1986. We are looking for trends, and we can find them quite clearly with investment trusts because the income and profits are identified in the revenue and capital reserves. If you look above you can see we also track the number of shares in issue, as they do indeed vary from year to year, and this can affect the dividend per share. Ever wondered why ‘buy backs’ are so popular and what impact they have on internal financials? We do too. We do the research so that you can avoid the puddles and keep your investing feet dry.

/2. The last time this happened.

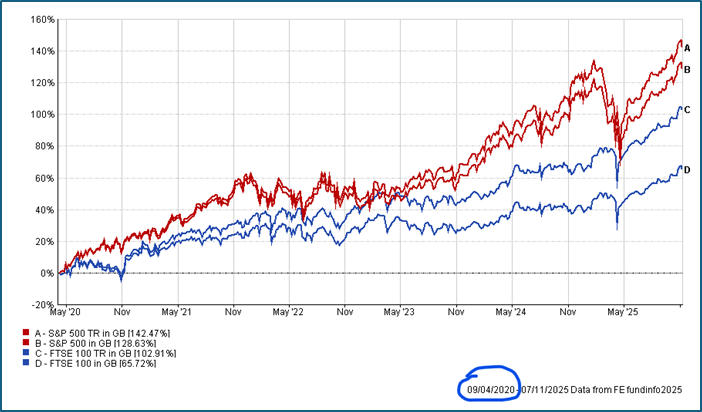

In March 2020 Covid threw a very cold shower over all the markets as no one knew what was about to happen; this wasn’t an issue of a bank(s) going bust or corporate valuations collapsing or frauds being exposed, at the height of our coronavirus fear it was a genuinely bottomless abyss. The chart above shows the turnaround point in April when the global population decided that we would indeed survive. This will happen again – we will see falls from these artificially inflated AI highs, and then when it shakes off, the market will simply turn round and climb back up. What you and I don’t know is the timing – so sit back, count the income coming through from the investment trust reserves and wait.

Like a driverless car on autopilot, it’s the $13 trillion in trackers that keep buying the S&P. Until they don’t.

/3. We invest in preparedness, not in prediction (you should too).

I can’t tell you what the new taxes in the budget will be, or when Ocado will break into profit or whether or not President Xi will knock on Taiwan’s door during his presidency. You and I know what will happen - there will be headlines of doom, as that’s the way they get you read their media output, and that’s how they make money.

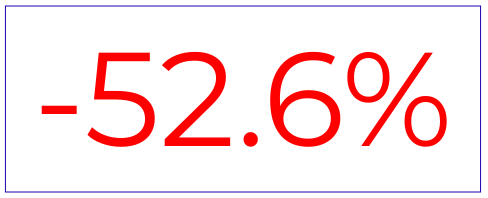

Most people reading this are over the age of 50 and saw the three consecutive years of market falls. It fell a total of 52.6% from peak to trough. Imagine if you were retired then on a DIY basis trying to work out how much to sell from your pension to use as income. For three years!!

It is because (because what?) we were working with clients throughout that period, managing money, and then through 2008 when the market fell -48% in one year.

None of the investment trust we use failed to increase their dividends in 2000, 2001, 2002, nor in 2008 or 2009. The strategy we use is designed to be defensive and ultra reliable because this will indeed happen again. Sit back, pick up a book, count your dividends and ignore the noise: retirees trying to work on total return will rue the day.

/4. Our story – ever wondered who we are and how Chancery Lane got here?

This is word for word text of an email I sent to a prospective client who wanted to know a little about how we work: I thought it might be ‘nice to know’ for readers, as a bit of background to us:

“Martin asked me to outline how we work, in answer to your email, and I thought it would be a good thing for me to do given your background. You are a slightly unusual client in that you have an extensive knowledge of the commercial environment and the challenges that companies face, perhaps with a more acute awareness of the issues that people are confronted with at retirement, more so if the retiree is a woman. [Read the bottom paras].

It’s a collegiate environment, which is why the office is open plan. Everyone has responsibility for all clients, and there is a client manager and adviser with primary responsibility per client, however there is also a split between the planning adviser and investing adviser. You as an income client, would have either Martin or I as the lead adviser, Nick (who you met) as your client manager and Jim Harrison responsible for the investment recommendation. In this way we ensure that every client has multiple sets of eyes to ensure objectiveness of recommendations.

I started the advisory business under my name in 1989, then incorporated Master Adviser in 1994; we grew that to circa 7,000 clients with a staff of around 46 and two offices in Covent Garden, however the advisers were not chartered, there was too much of a sales environment so I shut everything down, got rid of any adviser who was not chartered, got rid of all the company pension scheme business and took the client count down to around 250 with a staff of eight – shut the two Covent Garden offices and moved to Chancery Lane in 2008. We’ve been here for the last 17 years(!). It was at the start of Master Adviser that I first met Jeff Prestridge (Mail on Sunday). He’s ‘followed us’ because he knows we are consistent, and we specialise in just one area.

Steve Sharp, our founder marketing director, was a client whilst he was Lord Rose’s main board marketing director at M&S – in 2019 he suggested we raise external investment and build a pension income proposition to meet the needs of the retiring baby boomers, and the retirees with DC schemes. The original investors are Lord Rose, Bridget McIntyre (ex ceo RSA), Kim Lerche Thomsen (ex CEO Scot Amicable), William Todd (ex CEO Nutmeg), Steve Groves (ex CEO Partnership Assurance, current chair of Mobius Life) and Steve Sharp.

In order to qualify for EIS status the investment had to be via a newco, hence Chancery Lane as a separate company. I own Master Adviser outright and am the controlling shareholder of Chancery Lane – in time the two will be merged. Collectively we run around £165 million for around 250 families. The metrics of running a full-service business are fairly simple but – for some reason – completely ignored when evaluating businesses. Given 1,300 working hours per person per year, and 40/60-ish hours per client, we need [250 clients x 40 hours = 10,000 hours] /1,300 hours = 7 to 8 staff. By way of reference, Rathbones have 95,000 clients looked after by 3,500 staff, so a staff: client ratio of 1:27.

We do not currently market Chancery Lane: the corporate focus is sourcing scale-up external investment. We have our own research subsidiary and produce the only research in the UK analysing the data behind income options in drawdown. Private client work, such as yours, is very straightforward as this is what (for example) Martin has been doing for the last thirty years. The industry challenge we are addressing is the needs of those who are not as financially fortunate as you and me – there is a giant gap in the market that is being deliberately ignored by ‘the industry’ and which Torsten Bell has picked up.

The apocryphal Mrs Patel is retiring with £50,000 saved in her pension pot – who is going to look after her? We have spent £250k this year building an online solution to help her – we are in discussions (a generous description) with one Mastertrust that has 40,000 retirees, is entirely private equity funded and is only interested in buying up smaller pension schemes to get bigger and bigger – they have no commercial interest whatsoever in Mrs Patel. 62% of all money purchase pension money sits in company and group schemes, the average pension pot size in these schemes is between £1k - £8k because employees now have an average of 11 different employments in their working life.

And no one gives a hoot about Mrs Patel.

So that’s what we do, how we do it and who for: Chancery Lane works with two equal disciplines – empathy and expertise. We don’t try to suit everyone; we specialise in just one area and that is reliable investment income throughout life that deals with inflation. If that’s what you need, we’d love to have you as a client. Alternatively if you do want to explore investment market options and allocations to US/tech/commodity/blockchain driven capital investments, then I can recommend other firms to you – but I think you simply need to secure your income without the anxieties of what you and I both know are imminent in the world’s markets, both today and over the next twenty five years.”

Love all, serve all, we’re here to help.