Annuity rates, and that 20% per year.

by Doug Brodie

In this blog:

/1. Annuity rates, and that 20% per year.

/2. If you’re considering an annuity, is it cheaper to self-insure your pension income?

/3. Ten Years After – not the Nottingham band, it’s the tales of 10 people who retired 10 years ago. Regrets? They’ve had a few.

/4. Yale Research on ageing: how to live 71/2 years longer, actionable insights.

/1. Annuity rates, and that 20% per year.

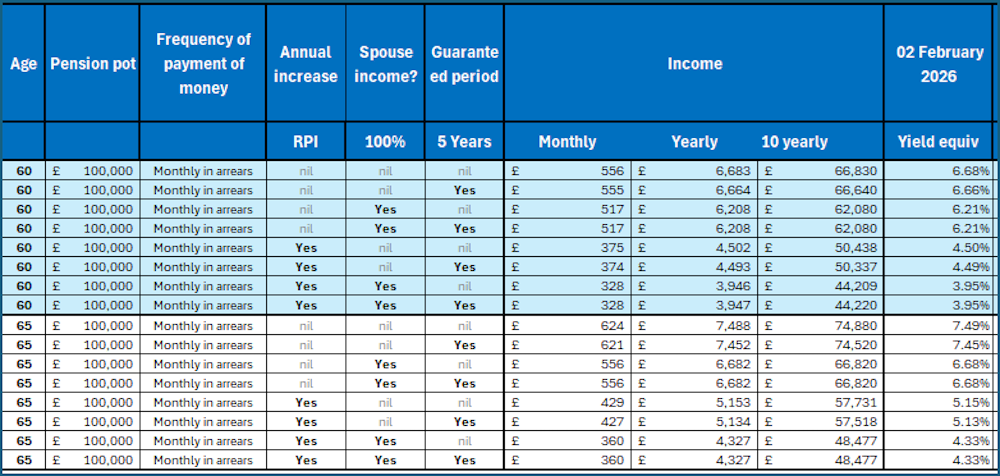

Current annuity rates:

Adam is in his mid-70’s and has been a client of ours for a number of years. He’s single, lives on his own in central London, has a professional consulting practice and has pretty much achieved all he wants in life, and certainly financially. He has a couple of adult kids, and the first grandchild turned up a few months ago.

The work with Adam has always been centred more on cashflow and financial planning rather than investment. His lifestyle costs more than the natural income we could generate for him, and he has been happy over the past years to drawdown on capital as needed. At the end of last year we prepared his annual update: a reconciliation of all income and all capital, measured against the previous twelve months and against the client’s objectives.

Adam had a stroke; he also had cardiac disease. Neither of those two knocked him out – however, their effects don’t go away. At this annual update, we did a full medically underwritten annuity quote for him – that’s not a question of dialling up Money Supermarket or Go Compare, it’s a question of knowing which annuity providers are currently in the market for impaired life annuities, which company does actually want the business and who has a realistic underwriting system. Skip six weeks and the quote came back offering to pay Adam an income return of 20% per annum, guaranteed for life with 3% annual increases. He said no.

Adam is a bright man, working in the medical field. First, he wanted to leave any pension residue to his kids instead of the shareholders of a pension company, and second, he reckoned that if the annuity company was betting on him dying in four years’ time (which they pretty much were: 80% to the retiree, 20% profit to the pension co) he knew he could run down his SIPP fund over a good few extra years, eking out capital and income as needed. Sometimes a guaranteed income is not really what the doctor ordered.

Another way of looking at the arithmetic is that the annuity company would give him back all his money over five years whilst they kept all the interest on it – with wholesale banking rates between 4’s and 5’s, and annuity books running into 10’s of millions, the profit to an annuity company is pretty much risk free as long as the retiree dies at the right time.

/2. If you’re considering an annuity, is it cheaper to self-insure your pension income?

The sole selling point of an annuity is the term ‘guarantee’, though interestingly, we rarely ever find a client asking about what actually underpins that guarantee. (It’s the Financial Services Compensation Scheme, covering (normally) 100% of the annuity). Probable and likely don’t cut the mustard here – remember F&C have paid their dividend every year without fail since 1868. Every year, including crashes, depressions and wars.

Sample UK Gilt Ladder Yields (Approx. 2025/2026 Data)

Short-Term (1-3 years):

0.125% Treasury Gilt 30/01/2026: ~3.21% - 3.50%

0.625% Treasury Gilt 07/06/2025: ~4.1%

0.125% Treasury Gilt 31/01/2028: ~3.7%

Medium to Long-Term (5-10+ years):

0.875% Treasury Gilt 31/07/2033: ~4.70%

1% Treasury Gilt 31/01/2032: ~4.58%

0.625% Treasury Gilt 31/07/2035: ~4.82%

Very Long-Term (20+ years):

1.125% Treasury Gilt 31/01/2039: ~5.02%

0.625% Treasury Gilt 22/10/2050: ~5.39%

4% Treasury Gilt 2060: ~5.5%

From the annuity table at the top of this blog, if you wanted your spouse to have 100% of your income when you die, and without any inflation increase, then the annuity rate would be 6.6%; that means you would need to live for (100/6.6) 15 years to get all your money back. Alternatively, if you invested instead in the 2060 gilt, you’d get 1% less income but get to keep 100% of your capital.

The other way to look at gilts is to build a ladder: this simply means you invest in gilts that mature each year going forward, so that in each year you get the income plus the returned capital – the two combining to make up your cash need for that year.

Imagine you need that 6.6% income, on, say, £500,000; a gilt ladder could look like this, income starting in five years’ time, lasting for ten years:

Gilt Ladder Example

Objective: £33,000 annual income (coupon + principal) for 10 years, starting 2031

Formula: For each gilt, the nominal amount needed = £33,000 ÷ (1 + coupon rate)

|

Maturity Year |

Gilt |

Coupon |

Maturity Date |

Price (£) |

Nominal Required (£) |

Final Coupon (£) |

Redemption (£) |

Total Income (£) |

Purchase Cost (£) |

|

2031 |

Treasury 4.125% |

4.125% |

07/03/2031 |

100.22 |

31,693 |

1,307 |

31,693 |

33,000 |

31,763 |

|

2032 |

Treasury 4.25% |

4.25% |

07/06/2032 |

100.69 |

31,655 |

1,345 |

31,655 |

33,000 |

31,873 |

|

2033 |

Treasury 4.125% |

4.125% |

07/03/2033 |

98.90 |

31,693 |

1,307 |

31,693 |

33,000 |

31,344 |

|

2034 |

Treasury 4.625% |

4.625% |

31/01/2034 |

101.43 |

31,541 |

1,459 |

31,541 |

33,000 |

31,992 |

|

2035 |

Treasury 4.5% |

4.5% |

07/03/2035 |

99.74 |

31,579 |

1,421 |

31,579 |

33,000 |

31,497 |

|

2036 |

Treasury 4.25% |

4.25% |

07/03/2036 |

96.94 |

31,655 |

1,345 |

31,655 |

33,000 |

30,686 |

|

2037 |

Treasury 1.75% |

1.75% |

07/09/2037 |

73.62 |

32,432 |

568 |

32,432 |

33,000 |

23,873 |

|

2038 |

Treasury 4.75% |

4.75% |

07/12/2038 |

99.18 |

31,507 |

1,496 |

31,507 |

33,003 |

31,249 |

|

2039 |

Treasury 4.25% |

4.25% |

07/09/2039 |

93.55 |

31,655 |

1,345 |

31,655 |

33,000 |

29,624 |

|

2040 |

Treasury 4.375% |

4.375% |

31/01/2040 |

94.26 |

31,569 |

1,381 |

31,569 |

32,950 |

29,757 |

|

Total |

317,979 |

329,953 |

£273,658 |

Key Points

Total investment required: approximately £273,660

What you receive each year: Around £33,000, comprising the final coupon payment plus the return of your nominal capital when each gilt matures.

Bonus income: You'll also receive intermediate coupon payments from gilts that haven't yet matured. For example, in 2031 you'd receive the final coupon + principal from the 2031 gilt, but also coupon payments from the gilts maturing 2032–2040. This provides additional income of approximately £10,000–£12,000 per year in the early years, tapering as gilts mature.

Tax treatment: Gilt coupons are subject to income tax, but capital gains on gilts held directly (not in a fund) are exempt from CGT. Gilts trading below par (like the 2037 gilt at 73.62) offer more of the return as tax-free capital gain, which can be advantageous for higher-rate taxpayers. Note, there’s no tax via ISAs, and within a SIPP the tax is only on the withdrawals from the pension.

Note: These are indicative prices as at early February 2026 and will fluctuate with market conditions. Dealing costs and accrued interest would also apply at purchase.

This example is just to illustrate how income can be guaranteed, though here the income table has only been run for 10 years, so the example is turning £273k into £330k. It serves to illustrate the principle, as it is providing the same 6.6% annuity income.

If you wanted to spend the whole £500,000 then the money would last for around 19 years: die before that and you’re quids in, die after that and you’ll be shelf stacking at Tesco…

Summary for £500k

|

Value |

|

|

Total purchase cost |

£517,415 |

|

Years of income |

18 (2031–2049, excluding 2048) |

|

Total income received |

£594,000 |

|

Total nominal held |

£567,064 |

|

Average purchase yield |

~4.3% |

/3. Ten Years After – not the Nottingham band, it’s the tales of 10 people who retired 10 years ago. Regrets? They’ve had a few.

Insightful research from the wonderful team at Ignition House has tracked a group of people of different ages, from retirement ten years ago. The team interviews the retirees every year, and now ten years later, these are the snippets, in their own words, of their experiences:

Age 74 – not sure if I can manage my money anymore, I’ve had prostate cancer and my wife isn’t interested in investments. Now I think I need someone to run my pension for me, and also to ensure my wife is not left with that task when I die.

….and then my wife had a stroke and all the plans disappeared as I became her full-time carer.

Having two state pensions helps pay all the bills, as it’s cheaper per head when you’re spending for two together – for example, the heating and costs of the house and the car. But then when one of you dies you suddenly lose half that guaranteed, inflation linked income: it’s devastating and makes life unaffordable.

Most people love the idea of retaining control of the pension through using drawdown, however the reality is that people set the drawdown income and portfolio once and then never change it, no matter what their good intentions were, because life takes over and the further away from your old working life you get the less enamoured you are to start doing all the investment research again from scratch. We just take the income as it comes, and if the capital runs out, we’ll deal with that problem then.

What did we do with the tax-free cash?

a. I bought a new car, added to my savings and took a big holiday.

b. I used it to move house and help my daughter to move house.

c. A bird in the hand… I took it all out, had a holiday and put the rest in savings.

d. I never did anything with it, I wish I hadn’t taken it out as I’d have a higher income.

e. I should never have taken it out, it’s reduced the pension income that I actually need.

We saw no evidence at all of a U-shaped spending curve, where retirees spend high at outset, then tame down their spending, then increase again with care and health costs.

And because we are Chancery Lane, here’s the real Ten Years After:

/4. Yale Research on ageing: how to live 71/2 years longer, actionable insights.

Anyone who sets up a communication network called Age Rebels is clearly on our wavelength, and Annie brings her extensive corporate career in this area to the forefront: she talks of a Yale research project by Becca Levy: “Breaking the Age Code: How Your Beliefs About Aging Determine How Long and Well You Live”.

In short, her research showed that a positive attitude to our retirement phase ties in with people living longer than those with negative attitudes. Be a positive person, it’s better than the alternative.

Here are the most actionable, evidence-backed takeaways from ‘Breaking the Age Code’, the stuff you can actually do, not just nod along to.

1. Audit your “aging script”

What to do: notice how you talk about age: “I’m too old for that,” “senior moment,” “over the hill.”

Catch both self-talk and casual jokes.

Why it matters: these phrases aren’t harmless. Levy’s research shows they directly affect memory, balance, cardiovascular health, and stress hormones. What you rehearse mentally becomes biology over time.

Tiny shift: swap “I’m getting old” for “I’m getting more experienced / adaptable / strategic.”

2. Replace decline stories with growth stories

What to do: actively seek examples of people who are thriving later in life (creatively, physically, socially).

Make them visible: books, podcasts, mentors, colleagues.

Why it matters: positive age beliefs act like a psychological vaccine against age-related decline.

People with positive age beliefs live c7.5 years longer on average.

Tiny shift: ask “What gets better with age?” (Judgment, emotional regulation, pattern recognition, leadership, resilience [Ed:….wine, cheese, buildings, music?])

3. Interrupt stereotype triggers in the moment

What to do: when you feel slower, forgetful, or tired, don’t default to age as the explanation. Ask: sleep? stress? workload? nutrition? distraction?

Why it matters: When people are reminded of negative age stereotypes, their performance drops immediately - even on simple tasks. The effect is psychological, not inevitable.

Tiny shift: “This is fatigue, not age.”

“This is a skill gap, not a birthdate.”

4. Use language strategically (especially at work)

What to do: avoid age-coded language like “energetic,” “digital native,” “seasoned but…”

Call out ageism gently when you hear it.

Why it matters: language shapes expectations → expectations shape opportunities → opportunities shape outcomes. Ageism at work shortens careers and worsens health.

Tiny shift: focus on skills, outcomes, and learning speed, not age proxies.

5. Treat aging as dynamic, not downhill

What to do: expect change, but not uniform decline. Assume plasticity: your brain and body respond to belief and behaviour at any age.

Why it matters: people who believe aging is flexible recover faster from illness, maintain better cognition, and handle stress better.

Tiny shift: replace “At my age…” with “With the right conditions…”

6. Prime yourself before challenges

What to do: before demanding tasks (presentations, physical activity, learning something new), consciously activate positive age beliefs.

Why it matters: Levy’s studies show that brief exposure to positive age cues improves memory, walking speed, and balance - instantly.

Tiny shift: mentally cue: “Experience helps here.” Recall a past example of competence, not youth.

7. Build intergenerational contact (on purpose)

What to do: spend real, meaningful time with people much younger and much older than you.

Avoid age-segregated bubbles

Why it matters: familiarity dismantles stereotypes. Intergenerational contact improves attitudes on both sides and reduces unconscious bias.

Tiny shift: mentor across age lines - in both directions.

8. Advocate beyond yourself

What to do: challenge ageism in policies, media, healthcare, and hiring. Support age-inclusive practices.

Why it matters: structural ageism has health costs comparable to smoking and obesity. This isn’t just personal mindset work - it’s public health.

Tiny shift: ask: “Would this sound okay if we swapped age for gender or race?”

Bottom line

Ageing is something that only happens if we are lucky.

Ageing isn’t just something that happens to you.

It’s something your beliefs help construct, daily, quietly, cumulatively.

Never old, simply older.

About the author

Doug is the Founder and CEO of Chancery Lane. He has worked with personal investing since 1989, specialising in income investing for the last fifteen years, firstly with Old Mutual and running his own award winning business since 1995. Doug is chartered with two professional institutes, CISI and CII, and certified by the Institute of Financial Planning.