How to beat inflation in retirement (probably)

by Doug Brodie

/1. Why investment trusts are better than tracker funds for retirement income that beats inflation.

When planning for retirement in the UK, one of the most important goals for investors is securing a reliable income that keeps pace with inflation. With rising living costs, ensuring that your money maintains its spending power is essential. While tracker funds (also known as index funds) are often praised for their low fees and simplicity, investment trusts may offer distinct advantages for retirees who need dependable, growing income. Here’s why.

1. Built-in income smoothing and reserve funds

Investment trusts are unique in that they can retain a portion of their income in good years. This retained income is held in a revenue reserve, which can then be used to maintain or grow dividend payments during tougher years, such as recessions or market downturns.

Tracker funds, by contrast, must distribute all income as it is earned. If the underlying index delivers lower dividends one year, your income falls.

Investment trusts can smooth income year over year - a vital feature for retirees who rely on steady monthly payments.

2. Proven track record of dividend growth

Many UK investment trusts have increased their dividends for 20, 30, even 50+ consecutive years. These are called "Dividend Heroes" by the Association of Investment Companies (AIC).

Examples:

City of London Investment Trust – 59 years of rising dividends

Bankers, Alliance Witan and Caledonia all have 58 consecutive years of rising dividends

This is especially important for retirees: rising income helps defeat the theft of inflation, which erodes the purchasing power of fixed income over time which is why we DON’T use fixed income).

3. Active management with a long-term view

Unlike passive tracker funds that simply mirror an index, investment trusts are actively managed. This means:

Managers can select stocks based on quality, income, valuation, and growth potential.

They can adapt to changing economic conditions, unlike a tracker that blindly follows the index composition.

In retirement, when consistent income and capital preservation matter more than short-term growth, this flexibility is an advantage.

4. Ability to use gearing (borrowing) strategically

Investment trusts can borrow money to invest (known as "gearing"). While this increases risk, if used wisely, it can also boost income and returns — especially in periods of low interest rates.

Tracker funds are not allowed to use gearing. This limits their ability to enhance yield or take advantage of compelling opportunities.

5. Better suited for income drawdown strategies

In retirement, most investors move into drawdown, where they take a regular income from their investments. Investment trusts that focus on high and growing dividends are ideally suited to this purpose.

Many offer yields of 4%, 5% or more, and many are even structured with monthly or quarterly income payouts, aligning with retirees’ cash flow needs.

By contrast, tracker funds typically pay income quarterly, and dividend yields from broad indexes like the FTSE All-Share or FTSE 100 may not be sufficient to generate a sustainable retirement income without selling capital.

Most importantly: investment trusts are required to pay out at least 85% of the income they receive. In good years they put the balance of >15% into revenue reserves. In a bad year they use the revenue reserve to maintain the dividend to you – there is no smoke and mirrors, it is simple arithmetic and good governance. Unit trusts, ETFs and pension do not have this option – they have to pay out 100% of what they receive in the year received and so have no reserves whatsoever to protect investors from the bad years (see 2020 for evidence).

6. Diversification and specialist strategies

Investment trusts often invest in diversified portfolios of UK and global companies, including those with strong pricing power, high margins, and inflation-linked revenues.

Some also specialise in alternative assets like infrastructure, renewable energy, property, or private equity - areas that are underrepresented in traditional indexes but can provide strong, inflation-linked income.

7. A better tool for income resilience

Tracker funds have their place in the investing world - especially for low-cost accumulation of wealth during the working years. But when it comes to generating reliable, inflation-beating income in retirement, investment trusts offer a superior toolkit.

Dividend growth histories

Income smoothing through reserves

Active selection and flexibility

Attractive yields and payout structures

For those entering or living through retirement, investment trusts could be the backbone of a durable, inflation-resilient income strategy.

/2. Investment Trusts vs. Tracker Funds: Performance & Charges.

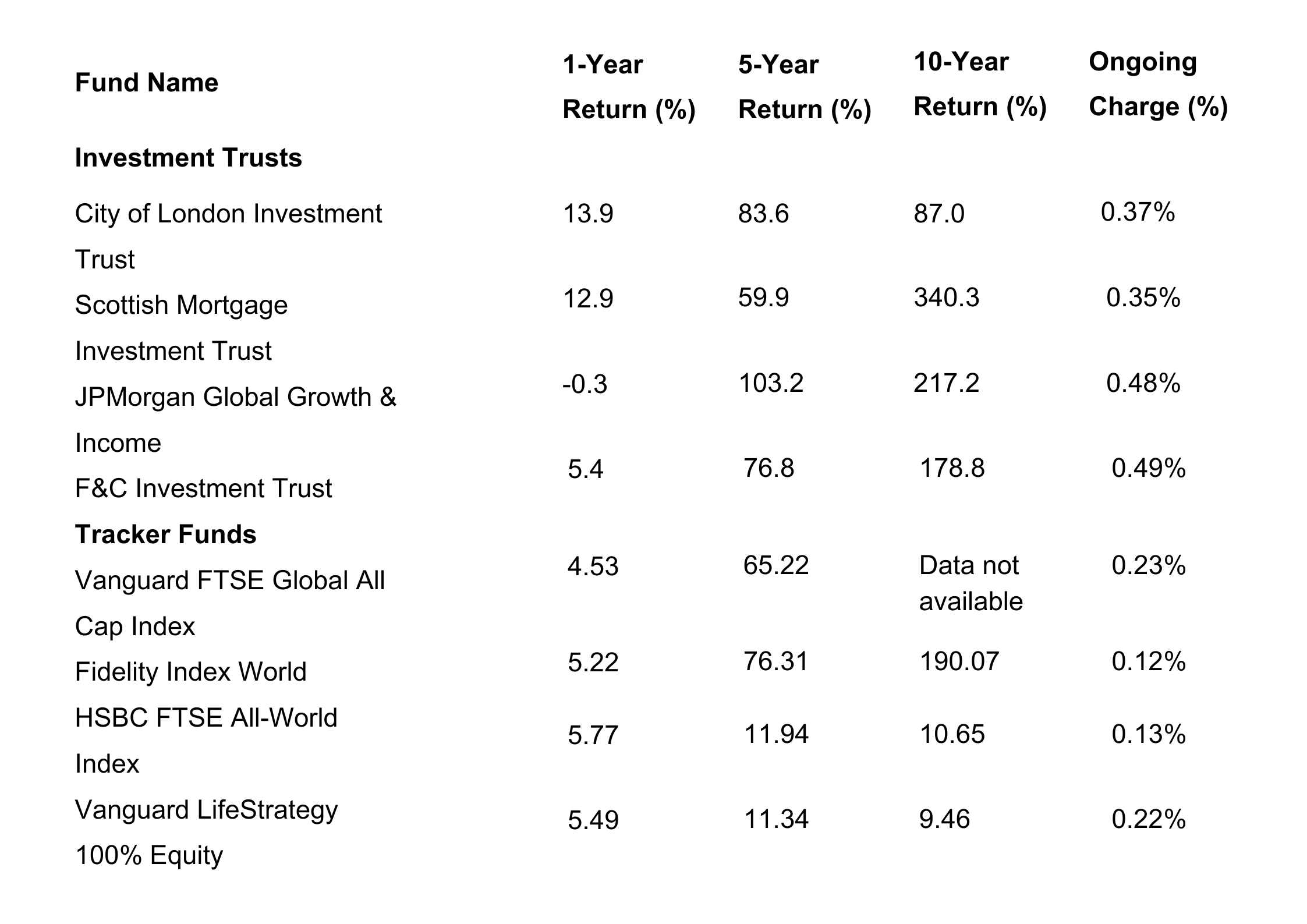

Note: Returns are total returns to 30 April 2025. Ongoing charges are the annual management fees expressed as a percentage of assets under management. Part source data FE Analytics.

Key insights?

Investment Trusts: The City of London Investment Trust has a notable history of increasing dividends for 58 consecutive years, making it a strong candidate for income-focused investors. Scottish Mortgage Investment Trust has delivered impressive long-term growth, with a 10-year return of 340.3%.

Tracker Funds: These funds offer broad market exposure at typically lower costs. For instance, the HSBC FTSE All-World Index fund provides diversified global equity exposure with a 10-year return of 10.62% pa, and the Fidelity Index World was 11.24% pa..(FE Analytics)

Last word…

While tracker funds offer low-cost, broad market exposure, investment trusts like the City of London Investment Trust and Scottish Mortgage Investment Trust have demonstrated strong long-term performance and dividend growth, which can be beneficial for generating retirement income that keeps pace with inflation.

And for the pedants: ‘zzyzzyva’ is the genus of a South American weevil, famously the very last word in the American Heritage dictionary. The commonly referred to source is that an entomologist in New York invented the name specifically to target the very last word in the dictionary.

/3. How to be happy in retirement.

“Don’t worry, be happy.” Bobby McFerrin had a hit with this song in 1988, as I’m sure you’ll remember. One of his sage lines goes:

“In every life we have some trouble,

But when you worry you make it double”

You’re not wrong Bobby!

The best way to be happy in retirement depends on your personality, health, finances, and relationships - but research and experience suggest that lasting happiness in retirement usually comes from a mix of purpose, connection, and security. This is a clear guide:

1. Stay connected to people

Loneliness is the #1 risk to well-being in retirement, even more than money or health.

Keep regular contact with friends and family.

Join clubs, volunteer, or participate in community groups - especially ones that meet regularly.

2. Have a purpose (do something, anything)

Retirement isn’t just about stopping work - it’s about what comes next. This could be:

Volunteering or mentoring.

Starting a small business or consultancy.

Learning something new (like art, language, or music).

Helping raise grandchildren.

People with a sense of purpose live longer and are mentally healthier.

3. Stay physically active

Walking, gardening, swimming, yoga - anything that keeps you moving helps your mood, memory, and mobility.

Exercise is linked to lower depression and higher life satisfaction in older adults.

4. Manage your money - but don’t obsess

Relax. Then create a budget that allows for enjoyment as well as essentials.

Use secure income sources (pensions, annuities, income investments) to reduce stress about running out of money.

Spend money on experiences, not just things - travel, time with loved ones, hobbies.

Do you think any of these people below give a hoot as to which one of them has more money? (What about health?)

5. Maintain a routine

A good retirement has structure, even if you’re not going to work.

Routines that include sleep, meals, exercise, and regular social or intellectual activity help you avoid drifting.

6. Keep your mind engaged

Read, take courses, do puzzles, explore hobbies.

Mental stimulation keeps the brain sharp and boosts confidence.

Many retirees enjoy lifelong learning programs at universities or online.

7. Give back

Volunteering is strongly associated with higher levels of happiness in retirees.

It gives you purpose, structure, and connection - all in one.

8. Look after your health

Get regular check-ups, eat well, sleep enough.

Stay on top of preventive care - it reduces worry and keeps you active longer.

9. Embrace them freedom

This is your time to do what you never had time for.

Travel, relocate, write a book, build something - even just rest and reflect.

10. Accept the transition

Retirement is a big life change. It’s normal to feel uncertain at first.

Give yourself time to adjust, and don’t be afraid to seek guidance or support if needed.

In short:

People are happiest in retirement when they are financially secure, socially engaged, mentally and physically active, and have a reason to get up in the morning.

Here’s a simple and practical Happy Retirement Lifestyle Planner & Checklist to help you shape a fulfilling retirement, step by step. I challenge you to swap this checklist with your partner, both of you fill it out for each other, not yourselves.