Forever Young

by Doug Brodie

/1. Gulf Oil and the 500% dividend.

Many readers here will remember Gulf Oil because of its motorsport sponsorship, most famously winning Le Mans with the Ford GT40.

The Rock & Turner blog on Substack raised an interesting item about dividends this week. The oldest bank in the US is the Bank of New York (Bony to its mates), which latterly acquired the investment bank founded by Andrew Mellon to form BNY Mellon. Mr Mellon was banker to Gulf Oil making it a rival to JD Rockefeller’s Standard Oil. Gulf was so ‘cash generative’ that in 1916 it paid a 500% dividend.

This was in part due to the ‘excess’ profits it was making in WW1, supplying fuel for ships, trucks and military machinery. The query amongst the investment fraternity is whether they should have used the cash for share buybacks, instead of dividends. For most shareholders it’s the return OF their money that takes precedence over return ON their money – capital security comes first. Equity investors are last in line if things go wrong, whereas debt providers are usually up front. The equity holders have their capital at risk, though the upside is unlimited.

If you bought $10k of Amazon stock at IPO it would be worth $25m today – if Amazon had simply borrowed the $10k from you it would have saved itself millions. Amazon pays no dividend (a bit like Berkshire Hathaway then) and can get away with that because it delivers such fabulous capita growth – and all of that is without any capital guarantee, whatsoever. Equity is the most expensive source of financing (compared to alternatives), so from the investor’s perspective, that’s where the value lies. It is actual, legal ownership of the company, so Gulf was simply sharing its excess profits with its owners.

/2. How to leave $8m in your will.

Few of our clients are in this bracket, so you should be encouraged to learn that Ronald James Read died in 2014 aged 92, his background was as a shop cleaner and petrol station employee. He bought a two-bed house when he was 38 and lived there all his life. Morgan Housel tells us that 2,813,503 Americans died that year and only 4,000 were in the same wealth bracket as Mr Read. (You can find him in Wikipedia). His wealth was from saving, not spending – he simply invested his savings in US blue chip stocks. There was no secret. He earned a little, saved a lot and didn’t spend much – simples.

Morgan compares him to another of the same era – Richard Fuscone was from Harvard, with an MBA, a banking superstar who retired in his 40’s – lauded for his ‘business savvy, leadership skills, sound judgement and personal integrity’.

However – not happy with his 18,000 square foot Connecticut home (two lifts, two pools, seven garages), he borrowed to extend, and all the while the house was costing him $90k per month to run. Then 2008 hit and he went bankrupt. James Read was patient and content, Richard Fuscone was never content and thought life was about bigger and better.

Money is a utility, it can’t compensate for an empty life, Richard Fuscone retired far too early, when all his chums were at work, kids still at school, so being bored, he thought the expansion of his mansion on borrowed money was a good idea. At the bankruptcy court he allegedly told the judge:

“I have no income”

What was the point? It certainly wasn’t happiness.

“Writing this column has helped me understand how much wealth done right is about outsourcing, not accumulating. Anyone with money can buy a fast car, a complicated watch or a T-shirt that says Armani across the front. More valuable is to rent other people’s time. Whether chartering a yacht or buying a suit, the smart way to operate is to seek out people whose tastes match yours, then reward them for doing the hard work of helping you live better.”

/3. Yes, you are paying more tax.

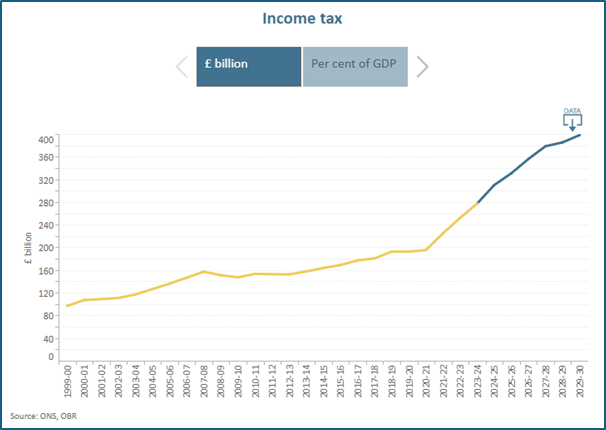

How ever you slice and dice it, the money has to come from somewhere. All politicians here and abroad think that no one has spotted that the rates of income tax are too low. They are, they should be raised. Fiddling with items such as VAT on school fees is about raising money, it has nothing to do a level playing field. Fiddling with pensions is just the same, yet no politicians appear to the political confidence to have an honest discussion with the electorate. Putting the ONS and OBR combined means we have a data pile that is likely to be as straight as you can find and the chart above paints a picture that needs no words of explanation – more tax will be taken in the coming years, and we are all the taxpayers.

I don’t like these charts; I have a Scottish attitude to debt – did you know that more of the tax you pay is spent servicing the country’s debt interest than is being spent on education? In the words of Mel Brooks:

“Enough already”.

/4. “Forever young” – the problem with DIY investing.

‘Forever Young’ is a truly fabulous song by Joan Baez. It was written by her ex-boyfriend, Bob Dylan, for his newborn son in 1966 when he lived in Tucson.:

“May the Lord bless you and guard you / May the Lord make His face shed light upon you.”

Bob first recorded it in 1973, and Joan released her version the following year, it hit 13 in the US charts. I heard it on the radio over the weekend recorded by Michael MacDonald – he of the Doobie Brothers and his eponymous work, I keep forgetting, On my own etc.

You can learn the words, you can hold a tune, but you’ll never sound like Joan Baez, which is why Michael MacDonald is not known for that song. Boozy family parties, weddings, funerals demonstrate that many people we know have learned the words of ‘My Way’ but they’ll never sound like Frank Sinatra.

The investment markets are the same for you, me and Warren Buffett (And Terry Smith, Paul Niven et al) and the fundamentals are well known – buy low, check volatility, do your due diligence, yet DIY investors will (almost) never sound like Frank Sinatra. Perhaps it’s because the professional investors spend all day every day watching, reading, studying. I don’t know. Perhaps it’s because they get to meet with and question the managers of the great funds, I don’t know. I do know that it is in part because they can identify the relevant characteristics in a fund, and that is not just about performance. The % stats will tell you where a fund has been (or investment trust, or ETF etc) when what you actually need to know is where it’s going. And you can’t do it without talent. People with good singing voices end up as singers, it’s not the other way round. You can’t learn to sing like Pavarotti or James Taylor or Michael MacDonald or Van Morrison – you can sing in the style of … but that will never match the original. You can invest in the style of …. but you’ll never match the original.

/5. If Buffet and Munger were partners, how come Warren got all the wealth?.

The simple answer is that Charlie Munger gave away a lot of his wealth whilst alive whereas Warren is keeping his till he dies. There’s another reason – fifty years ago there was a third partner called Rick Guerin.

“Charlie and I always knew we would become incredibly wealthy. We were not in a hurry to do so; we knew it would happen. Rick was just as smart as us, but he was in a hurry.”

Being in a hurry, Guerin leveraged his investment (ie borrowed to buy more), in the 1973/74 crash he got caught and had to sell out – Warren bought, Charlie didn’t. All three founders were skilled at investing however Rick made his portfolio infinitely more risky than the others simply because he couldn’t wait.

Warren Buffett’s wealth has been created by two things: his investment skills and his personal financial planning. He doesn’t do Ferrari’s, fine champagne, jets, yachts or 15,000 sq ft mansions. This is his home in Omaha – he bought it in 1958 for $31,500, never moved since then.

It’s not a house to Warren, its his home. We are often asked abut how much money a person will need when they retire and that is not a question of income, it’s about expenditure. Warren is empirical proof – if any was needed – that you don’t need money to be happy.

/6. You might not need us, here’s a wider used alternative.

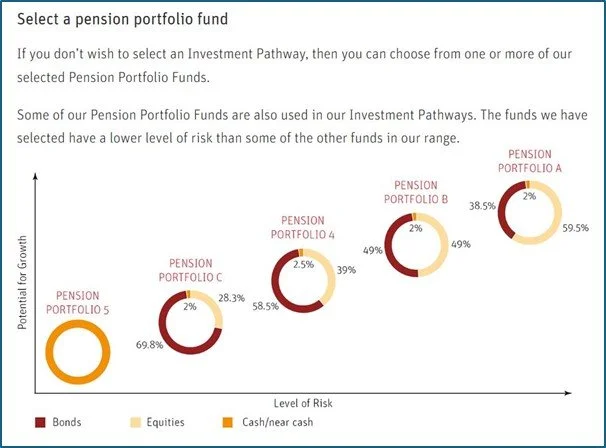

Our own investment portfolio research and application takes over 5,000 hours per year, and we are just a small company. Everything we do is bespoke, however not everyone needs that. It’s a lot cheaper to follow the pre-created bulk portfolios that you can access in a bank, pension company or company scheme. Those funds make all the decisions on investments, so you don’t have to be involved, and as they are normally measured in £’00’s of millions they are usually (but not always) cheap. All you have to do is decide which portfolio is best for you, and when you retire, how much income you want to draw.

The picture above if from a high street bank that owns a household name insurance and pension company – it’s what they offer, and it could be what you are looking for.