Is it debt or credit?

by Doug Brodie

/1. Is it debt or credit?

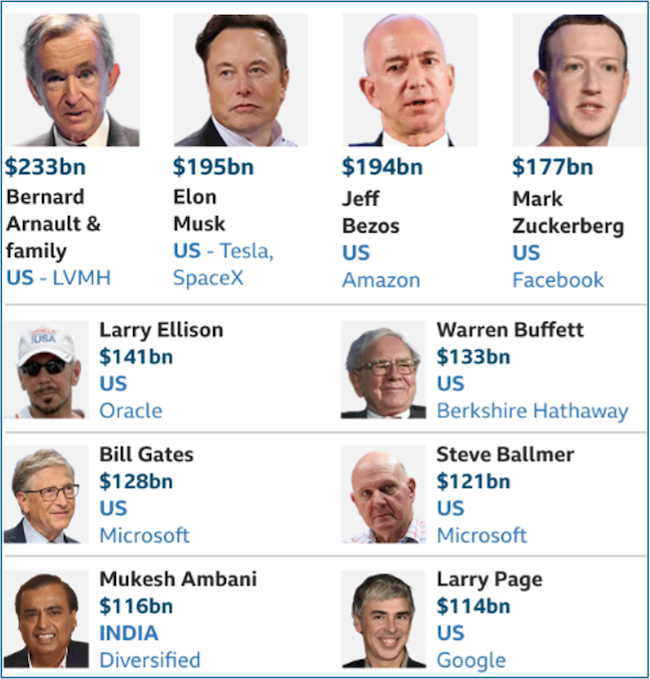

The wealthy use debt as a wealth creator. They borrow to buy assets that appreciate in value and put more money in their pocket.

All these fortunes have companies holding $billions of debt:

Chris Hohn’s hedge fund, TCI, paid him $81 million as a dividend last year, having made big, big bets on the aerospace sector. The fund holds $ billion positions in GE Aerospace (engines), Microsoft, Moody’s and Visa. No one can see how much of his bets are using borrowed money, though it certainly does. The maths is simple – start with £10, invest and get a 15% return and you have a 15% profit. Borrow £90 to add to your £10, invest the now £100 and get the 15% return, which is £15 – you’ve made a profit of 150% on your original £10. Yes, you have to pay interest on the borrowed money, however, you get the principle behind it.

Interestingly, the FT also reports that the group’s accounts show it made a $797 million charitable donation, Chris Hohn is the founder of The Children’s Investment Fund Foundation. Good chap, money well used.

The poor buy things on credit, which lose value. They become debt slaves. When they borrow, the person they borrow from is in credit, the borrower who spends on devaluing items is in debt and has to find income from somewhere to pay the creditor both the capital and the interest.

“Wealthy people receive interest, poor people pay it.”

Borrowing to invest is a thing in the retail market in the US and in Hong Kong, it’s basically not allowed in the UK.

Here’s why:

Think of the £10 example above. If the investment goes up 15% you made £1.50 and if you borrowed (geared) to £100, you made £15 profit, 150%.

Now imagine the investment falls by 15%: with your £10 you now have £8.50 being a loss of £1.50, BUT if you had borrowed up to £100, your loss is £15, being a total loss of all your own money, plus you still owe the lender a further £5.

This happens a lot in the US and Chinese retail investment markets.

In the States: the biggest stockbrokers are the banks, and they use retail advisers to bring in retail clients, plus they make it very, very easy for people to trade on their own, DIY. What happens is the banks offer the customers borrowed money to invest with – so someone with $100k can actually trade with, say $300k, with the goal of making three times the profits.

The banks make more money from bigger customers, the trades are bigger, the fees are bigger, transaction costs are bigger and they get to charge fees and interest on the loans they provide. I believe the Bible termed this usury? As usual, there’s no such thing as free money, and if you can’t see the price tag, you’re the product.

/2. Why the 4% Rule doesn’t work in the UK.

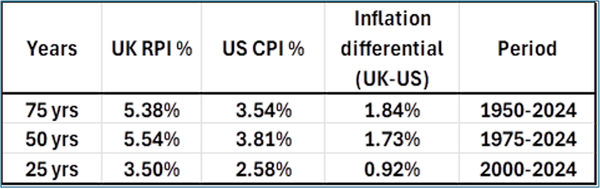

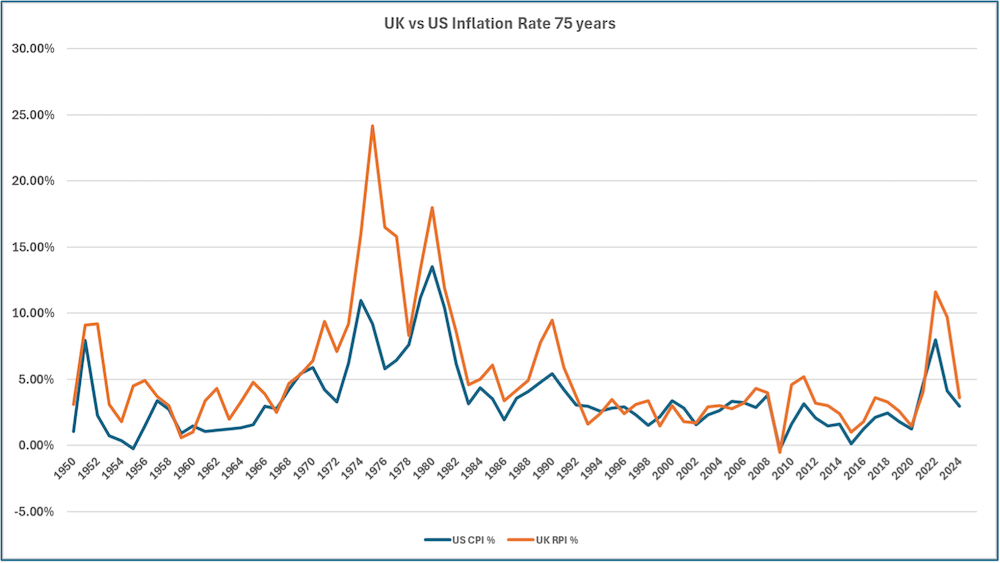

Bill Bengen is a US planning specialist and former rocket scientist; he ran the maths to work out the safe percentage that can be drawn from pension capital, with inflation, such that the capital will not run out. He used the S&P 500, RPI, US bond markets in a mix, and came up with 4% of the starting capital.

These are the stats for US and UK RPI; over the last twenty-five years UK inflation was 35.6% higher. The maths doesn’t work for the UK, even before you add in the disparity between the US and UK equity markets.

This is why we use natural income.

The reason there is no simple magic figure to draw from a pension is because there is no simple magic figure.

/3. You’ve done some things, but have you done this?

If you’re going to be cold in January anyway, why not have a story to tell about it at the end of year.

“Hi Tom, what did you last winter?”

“I sat at home paranoid about the heating bills showing up on my Nest thermostat”.

Which neatly leads on to …

/4. You’re a long time dead

There’s always something going on, pretty much everything is cyclical and most (all?) of what you read and see and hear of any daily news will not affect your life today one jot (weather aside, obvs).

For you and me who have lived a little, the saying “Be happy while you are living, because you are a long time dead” carries real weight. Together we’ve seen decades come and go, watched the world change, raised families, built careers, and weathered disappointments as well as triumphs. Time, as we know now, moves faster than we ever expected. You and I watched the moon landings, I watched Kennedy’s and Churchill’s funerals on a small black and white TV, we were taught in school that 12 pennies made a shilling and we now send money using our phones and watches just by tapping.

Happiness at this stage of life isn’t about chasing everything or proving anything. It’s about appreciating what is already here: good health on a decent day, a familiar voice on the phone, a quiet morning, a shared laugh. It’s allowing ourselves to let go of old grudges, regrets, and the constant pressure to be productive.

We’ve earned the right to enjoy life’s simpler pleasures without guilt. Being happy doesn’t mean ignoring the world’s problems; it means choosing not to postpone joy. The truth is clear: this life is the one we get. The child is father of the man, and in the same way, it is you today who dictates what will be written in the review of your year in December – next, not last.

Taking the trip now, even if it’s modest, instead of waiting for a “perfect” time that may never come.

Spending an afternoon with grandchildren or old friends, choosing connection over chores.

Saying yes to the cake, the glass of wine, or the second cup of tea, without guilt.

Letting go of old arguments or resentments, recognising peace is more valuable than being right.

Enjoying slow mornings, reading the paper, gardening, or sitting quietly without needing a reason.

Pursuing a long-put-off hobby - painting, music, walking, volunteering - purely for pleasure.

Turning off the news occasionally, protecting your mental space.

Laughing at yourself, rather than worrying what others think.

/5. AI, The Vietnam War and Watergate.

50% of the population has to be below average; that counts for intelligence, income, wealth, health, everything. Social media stiffs the top moments of the top 1% and insinuates to you/us that that is normal, average. Morgan Housel puts it succinctly when he points out that when the majority of people expect a top 5% outcome - the result is always mass disappointment. As we get older, the ambitions move from optimistic to realistic. He goes on:

Imagine if you asked people 25 years after these things were invented whether life was better or worse because of their existence: Electricity, radio, airplane, refrigeration, air conditioning, antibiotics, etc. I think nearly everyone would say “better.” It wouldn’t even be a question.

The internet is unique in the history of technology because there’s a list of things it improved (communication, access to information) but another list of things it likely made worse for almost everybody (political polarization, dopamine addiction from social media, less in-person interaction, lower attention spans, the spread of misinformation.)

There aren’t many examples throughout history of technology so universal with so many obvious downsides relative to what existed before it. But the wounds are so fresh that it’s not surprising many look at AI with the same fear. This is more hope than prediction, but I wouldn’t be surprised if in 20 years we look back at this era of political nastiness as a generational bottom we grew out of. There’s a long history of Americans cycling through how they feel about government and how politicians treat each other.

The 1930s were unbelievably vicious. There was a well organized plot to overthrow Franklin Roosevelt and replace him with a Marine general named Smedley Butler, who would effectively become dictator. The Great Depression made Americans lose so much faith in government that the prevailing view was, “hey, might as well give this a shot.”

It would have sounded preposterous if someone told you in the 1930s that by the 1950s more than 70% of Americans said they trusted the government to do the right thing almost all the time. But that’s what happened. And it would have sounded preposterous in the 1950s if you told Americans within 20 years trust would collapse amid the Vietnam War and Watergate.

Go back to this week’s email where I outlined the sheer financial muscle that the US holds and work out what the US electorate’s feelings will be in twenty years’ time, when the incumbent White House cabal will be long gone. Dogs will still bark, the sun will still rise. Carpe diem, and we know, from our ages of experience, that this too shall pass.