The Yield Illusion

by Doug Brodie

/1. The Yield Illusion

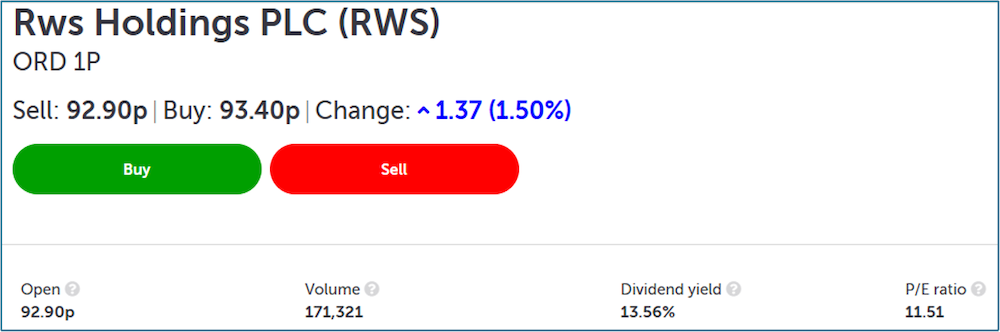

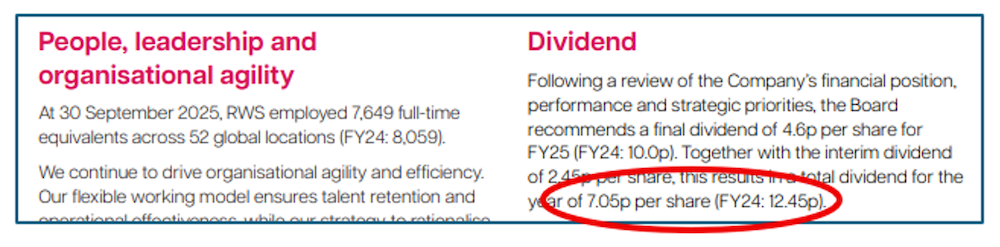

Headline yields often look compelling, but they can be dangerously misleading if taken at face value. A quoted yield of 13.56% might suggest rapid capital recovery. Using the Rule of 72, investors could assume their purchase price is effectively repaid in just over five years, giving the impression that the remaining investment is “risk-free”.

However, this assumption only holds if dividends remain stable or grow. In reality, yields are backward-looking, calculated using last year’s dividend divided by today’s price. If dividends are cut, the apparent yield collapses. For example, a company advertising a 13.56% yield that subsequently cuts its dividend by 43% delivers an actual yield of just 7.54%. Investors who relied on the headline figure may find their income projections significantly overstated. The lesson is simple: always assess dividend sustainability, not just yield percentages.

The picture above shows the trading platform’s data on the stock, the picture below shows the excerpt from the report & accounts – the 7.05p dividend at the quoted 93.4p share price is a 7.54% yield.

/2. Gold will go up, down or sideways this year:

/3. Who’s buying at this level? Keep pumping your trackers

It’s you, silly.

In the MSCI ACWI Index (don’t panic – just a basket of about 2,500 of the world’s biggest companies), about 66% of this sits in the US today. Think of this another way. About £66 of every £100 you invest in this big global basket will be in the US. And about £21 will be in the Magnificent 7 – the tech gang which includes Nvidia, Apple and Microsoft. Huge concentration risk. Around 34% of any holding in an S&P500 tracker is in the Mag7, so every investment made into the tracker supports the current share prices by default.

Unwind ten years and back in 2015, the concentration of those companies was 12% of the S&P. The current market cap of the 7 is c$20 trillion, and that has doubled since 2022, just three years.

/4. Easy money, daily habits.

I know if I ask the question ‘Could you do a marathon?’ only a few readers would say yes, yet there are many who track their steps. Doing 10,000 steps per day means you’ll cover more than 70 marathons per year.

If you believe you don’t have time to read, then bear in mind that 20 pages a day means you’ll cover 30 books in a year. Lastly, the concept of asking our kids to save £3,000 will sound way out of reach, however, £8 per day is much more accessible.

I know I’ll run 2,000 kilometres this year – not because I have a clue what 2,000 kms look like, but because I run 5 km every day. Financial discipline is just the same, as it is the acquisition of habits in retirement. Obviously, you and I are going to have lots and lots of days to come, so little changes will compound to a material effect. If you and I eat one orange every day, then we’ll both eat five of these each in a year.

/5. Do what frightens you: here I come, ready or not.

Retirement uncertainty can create hesitation, but avoidance does not reduce risk — it delays fulfilment. Much as we might try, we can’t turn back the clock, so waiting and waiting just puts back the living we’re supposed to be doing.

Fear doesn’t stop death, it stops life, so the focus in retirement really does need to be on the living of it. There’s a note on my desk that says:

You can’t be in control of external events, though you are in control of how you react to them.

That’s a really important line to help recognise and deal with emotional reactions to the markets; they are cyclical, they fall regularly, retail investors come very unstuck when they let their emotions take over. Don’t.

The quickest way to acquire the self-confidence you need in those areas that you fear – how to fill days, where the groups of friends will be, stepping away from the employer-backed salaries – is to do exactly what you are afraid to do.

“Come on in, the water’s lovely”.

Once you have dived in, you’ll know exactly how it feels, anything before then is just theory and the re-hashing of other people’s retirement stories. Real peace is learning to be steady in the new uncertainty. If you think it depends on everything going right, it’s control you’re chasing, not peace. The perpetual nature of time means you have to live your retired life, not keep waiting for it, so the retiree needs to swap the ‘What if?’ mindset to ‘Even if...’.