It’s not about the data: it’s all about the data.

by Doug Brodie

/1. GDPR – sorry, you can’t read it, it’s GDPR chum.

Both Professors Cox and Wade live and work with data and the compilation of information, it’s important to remember though that there are two equally important steps to research. One is to find, collect and collate the data, the second is to interpret it and discern the meaning and what the data indicates (sometimes nothing).

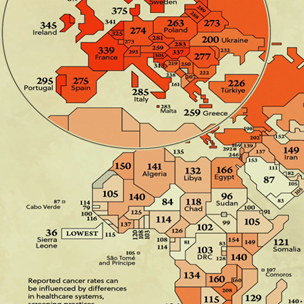

Kseniia Gostieva is the main data hunter in our research subsidiary, however once she has compiled the data in a manageable format, it is the firm’s advisory team which pulls it apart and runs it through myriad filters and comparisons to see if there is anything we can learn from it. We go back to it again and again and again. Data on its own, such as statistics you might find in the media, can be exceptionally misleading. There’s a brilliant example from our chums at Visual Capitalist with this diagram showing the rates per 100,000 of cancer rates:

You might look at this and wonder if you should move to Sierra Leone, but I wouldn’t, the actual life expectancy there is only 61, compared to Africa at 64 and the world at 71 (WHO). Are the incidences of cancer in the west so much higher because we’re testing more? Because we simply test for a wider variety of cancers? Because our equipment is more modern? Because there are commercial or political influences in the data analysis? Or the data collection?

The best kind of financial adviser is always a numerate sceptic; especially so in the investment sector where so many investment houses are after your money – like the brand new LTAF offerings you’ll read about. The simplest protection you can have is never consider anything you cannot do due diligence on, and for us that means waiting for five years so there is a track record that can be analysed. So, LTAFs can wait…

There are parts of America we love…

The advisers there have some great stories, and the mythical Mrs Snooks has her annual review written quite frequently; we like this latest version –

“It's that time again, for Mrs Snooks' six-monthly meeting with her adviser.

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Ah, welcome back Mrs Snooks, I hope you summered well.

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Hmmm, yes. Using all those dollars from my portfolio, in the Lake District!

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: So, I was reading about this evidence-based thing you have got going on and how it's difficult to predict what region, style or sector is going to do well.

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Yes, absolutely - that's the essence of it. None of these dreadful active managers trying to second guess things.

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Yet, you have decided to have two thirds in one region? It must be a good one.

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Ah yes, these are the best companies in the world, Mrs Snooks.

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: So, the US has done better than the UK market this year then, for me?

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Well, no. Not this year

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Europe

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: No

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Japan

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Erm, no

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Emerging Markets?

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Nope

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Right. So, how much am I paying for this, so called, evidence?

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Ahh, I'm glad you asked Mrs Snooks. This one is as cheap as they come. Just 0.15%.

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: No, son, how much am I paying for the stocks in this thing?

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: Ah well, things are a little on toppy side I suppose, 24x earnings if you must ask, but have you read about all the wonders of AI, Mrs Snooks. See, here: Ask it anything?

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬 𝐭𝐲𝐩𝐢𝐧𝐠: "By what amount would my portfolio fall in value if valuations returned to long term average?"

𝐂𝐡𝐚𝐭𝐆𝐏𝐓: "That's a great question. Your portfolio would fall by around 35%, if valuations returned to their long term (20 year) average."

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Right, so I'm saving 0.20% for having the cheapest possible portfolio, but paying a 35% premium for the privilege?

𝐌𝐫𝐬 𝐒𝐧𝐨𝐨𝐤𝐬: Did someone not once say: price is what you pay, value is what you get?

𝐀𝐝𝐯𝐢𝐬𝐞𝐫: No, I don't think so.

/2. All your tax free allowances – use them to generate £16,000+ tax free.

We run money on 11 different platforms, however clients will generally know our main ‘go to’ platform is run by AJ Bell. Laura Suter is a personal finance head there and has provided a really useful aide memoire for us all:

“These five simple tax tips don’t require you to have a six-figure salary or a team of advisers on speed dial. They’re well within reach for the average household and are fully sanctioned by HMRC – so there’s no need to feel like you’re gaming the system. In fact, these allowances and exemptions are designed to help people make the most of their money.”

It’s also a good nudge for couples to think about how they divide their income and savings, as small changes can make a big difference to the amount of tax you pay as a household. And if you can squirrel away the money you’ve saved into a savings or investment account, it could give your finances an extra boost for the future, whether that’s for a holiday, a house move or just a rainy-day cushion.

1. Marriage allowance – £1,260

The marriage allowance is a great way to claim some money back if one half of the couple earns less than £50,270 a year and the other either earns less than £12,570, or doesn’t earn any money at all. The government lets those who are married or in a civil partnership share their tax-free earnings allowance each year. It means that if one of you hasn’t used up your personal allowance of £12,570 a year you can hand it over to your partner. That could save you up to £252 in the current tax year. It’s thought around two million couples are eligible for this tax break but not claiming it, and even those where one half of the couple is retired can claim the tax break.

What’s even better is that you can backdate any claims for up to four years, assuming you were eligible in those years – which would get you a total of £1,260, including the current year’s claim. You can claim it online directly through the government, you’ll just need yours and your partner’s National Insurance numbers plus some forms of ID. You can check if you’re eligible using the government’s calculator. But beware of scam websites that are mocked up to look like the government website but are actually imposters.

2. Trading allowance – £1,000

Everyone can earn up to £1,000 tax free from side hustles or other money-making endeavours that are separate from their main job. The so-called ‘trading allowance’ means that if you earn £1,000 from property or trading income it will be tax free – if you’re a basic-rate taxpayer this will save you up to £200 a year, or £400 a year for a higher-rate taxpayer.

It’s great for people doing a bit of work on the side, for example babysitting, selling items on an online marketplace as a business, renting out your driveaway, dog-walking or even selling jam at the local market. The good news is that if you earn less than £1,000 a year from your side hustle then you won’t usually need to fill out a tax return. Just make sure you keep track of any relevant paperwork proving your income in case HMRC asks for it later. If you earn more than £1,000 from your side hustle in a tax year, you’ll still benefit from the tax break, but you’ll need to fill out a tax return to declare the extra income and pay any relevant tax.

3. Rent-a-room scheme – £7,500

The government gives a tax break for anyone who rents a room out in their home. Lots of homeowners are looking to do this to generate extra money and try to counteract the rising cost of mortgages. You can make up to £7,500 a year tax-free through rent-a-room relief, which will save you up to £1,500 a year as a basic-rate taxpayer or £3,000 a year if you pay income tax at 40%.

You must be renting out a room (or multiple rooms) in your home, rather than a separate flat, and the room must be furnished. But it’s not limited to a room, you can rent out as much of your home as you like. You can also use it if you run a B&B or guest house, so long as it’s in the same property you live in. You don’t even need to own the home to benefit, you could be renting out part of your rental property – however, you’ll need to check that your lease doesn’t prohibit that.

You don’t have to let the room for a minimum period of time. But be aware that if you own the property jointly with someone and split the income, you only get half the relief per person. If you earn less than £7,500 a year from renting out a room, you won’t need to fill in a tax return, but if you earn more than the tax-free limit you will.

4. Claim tax-free childcare – £2,000

Families can claim up to £2,000 a year per child towards childcare costs, which can significantly help towards nursery, childminder or holiday club costs. The allowance is split into £500 per quarter and requires you to open a tax-free childcare account and pay money in. For every £8 you pay into the account the government will add £2. You then pay the nursery directly from the childcare account.

Not all parents will be eligible: they must both be working and each earning the minimum wage for 16 hours a week or more, but also earning less than £100,000 adjusted net income per parent. You can claim the money per child and use it up until 1 September following their 11th birthday. If you have a disabled child, you can claim up to £4,000 per year up until their 16th birthday. You can also claim tax-free childcare at the same time as claiming the 30-hours of free childcare, assuming you’re eligible for both. You’ll need to log in to your Government Gateway account and register for tax-free childcare from there, and the government will then approve your account before you can get started.

5. Make use of the £5,000 tax-free savings allowance – £5,000

Anyone with income of £12,570 or less gets a £5,000 tax-free allowance for their savings income. Called the ‘starting rate for savers’, it means that you don’t pay any tax on the interest on your savings up to £5,000. Based on the current top easy-access account savings rate of 5%, that means you could have up to £100,000 in savings before you’d be hit with the tax. If you were taxed on that £5,000 of savings income it would equate to £1,000 of tax for a basic-rate taxpayer – so it’s a very generous tax saving.

Even if you earn between £12,570 and £17,570 you could still benefit from this tax-free savings allowance, but on a smaller amount. For every £1 of income you earn over £12,570, you lose £1 of the savings interest tax-free allowance. For example, someone who earns £1,000 over the limit will be able to earn £4,000 of savings interest free of tax.

This trick is particularly handy for couples where one has a low income but as a household they have a decent amount in savings. If you transfer the bulk of the savings to the lower-earning half of the couple, you can maximise the tax-free limit. Retiree couples could also find it handy, as if one of them is just reliant on the state pension they will be within the earnings limit and often retirees have large cash savings pots to live off during retirement.”

/3. Hey you, don’t watch that watch this…

The dividend paid out by Merchants Trust has increased every year that it has been run by Simon Gergel – you may have noticed that when you read commentary on any trust they talk about the yield, and that yield is as wobbly as a 5 year olds front tooth. The yield is as movable as the share price – as the share price moves, so the yield moves. The yield is the last year’s dividend (which is fixed, cannot ever change) over the current share price (which is in perpetual motion). As a result the yield always moves.

Seeing the light: the relevant figure is the yield to cost – the yield above is yield to current, current being the current price, and that is showing what the yield would be if you buy today. For an investor, the price (share price) is fixed, not floating, because you’ve already bought the shares, so your yield to cost is the last dividend over the price you paid. This is stable, you’ve already locked in your price, and as the dividends grow, so your yield to cost grows (growing income in £sd over the fixed price).

/4. This pension paid the beneficiaries for 135 years: how long do you need yours?

Part of our work is knowing who the clever people are, and Dave King at Aries Insight is definitely one of those whose numbers we keep in the phonebook under ‘in case of emergency’.

I’ve had 35 years in this industry listening to ‘pensions simplification’, and how everything is to be stripped back and made easy for people to understand so they can take control of their own affairs. We haven’t yet had the rules out about pensions and IHT yet there is still fall out from the removal of the lifetime allowance. This is an article Dave wrote in Mallow Street outlining considerations when calculating death benefits from a pension: unless you are really into this kind of thing, I’d skip to the sports page – it is very (hmmm) dry, however I include it here to give an finite example of why pension matters are complex, take so long and cost money to administer. It’s a pig.

“I was recently asked a question concerning the calculation of a member’s available Lump Sum Allowance and the ‘age 75 BCEs’ disregard that applies under the default calculation (i.e. where there is no Transitional Tax-Free Amount Certificate in force).

By way of background here, broadly speaking, Paragraph 125 of Schedule 9 of the Finance Act 2024 provides that, where the member has had a Benefit Crystallisation Event under any registered pension scheme between 6 April 2006 and 5 April 2024, their ‘full’ LSA is reduced by 25% of their ‘Lifetime Allowance previously used amount’.

So far, so good. The term ‘Lifetime Allowance previously used amount’ is defined in Paragraph 129 of that Schedule and generally means that amount of the member’s Lifetime Allowance that would have been deemed to have been used up if the member had had a Benefit Crystallisation Event on 5 April 2024.

There is, however, an exception to this general rule where:

· the member reached age 75 before 6 April 2024; and

· on reaching age 75, the member had an ‘automatic age 75 BCE’ (i.e. a BCE 5, 5A or 5B) under any registered pension scheme; and

· between reaching age 75 and 5 April 2024, the member did not become entitled to a lump sum under any registered pension scheme.

In such cases, the member’s Lifetime Allowance previously used amount is reduced to reflect that ‘automatic age 75 BCE’. This is sometimes referred to as being the ‘age 75 BCE disregard’, but the way this works is rather more subtle than it may initially appear.

What the legislation actually provides for is that, where the three bullet points above apply, the member’s Lifetime Allowance previously used amount is initially calculated as described above, but that the result is then reduced by the amount(s) crystallised on any age 75 BCEs. The impact of this can bee seen in the following example.

Example

Suppose that a member reached age 75 in the 2016/17 tax year with an uncrystallised money purchase fund of £800,000. The standard LTA for that tax year was £1,000,000, so the BCE used up:

£800,000 / £1,000,000 X 100 = 80.00% of their LTA.

If this was the member’s only BCE, then – if that BCE were disregarded, the member would still have 100% of their LSA and LSDBA still available. For the LSA, this would mean a figure of £268,275.

What actually happens, however, is that the member’s lifetime allowance previously used amount is reduced by the amount that crystallised on the age 75 BCE (rather than disregarding the occurrence of the BCE itself). For LSA purposes, then, the required calculation is as follows:

Member’s ‘headline’ LTA previously used amount is £1,073,100 X 80% = £858,480

This is, however reduced by the amount crystallised on the age 75 BCE:

£858,480 - £800,000 = £58,480

The member’s LSA is then reduced by 25% of this LTA previously used amount of £58,480:

£58,480 X 25% = £14,620

Member’s available LSA is £268,275 - £14,620 = £253,655.

The crucial point is that it is the specific amount crystallised at the age 75 BCE that is deducted from the lifetime allowance previously used amount – that amount is not adjusted or revalued in any way, even if the lifetime allowance applying to the member at the time was different from the one which applied on 5 April 2024.

As such, the age 75 BCE is not completely disregarded – rather it must still be taken into account but then an adjustment can be made in respect of it.

Now, in the above example, the standard LTA at the point of the age 75 BCE was less than £1,073,100. The next question to ask is what would happen if the standard LTA at the date of the age 75 BCE was more than £1,073,100. Again, an example may be helpful here.

Example

Suppose that a member reached age 75 in the 2013/14 tax year with an uncrystallised money purchase fund of £800,000. The standard LTA for that tax year was £1,500,000, so the BCE used up:

£800,000 / £1,500,000 X 100 = 53.33% of their LTA.

Member’s ‘headline’ LTA previously used amount is £1,073,100 X 53.33% = £572,320

This is, however reduced by the amount crystallised on the age 75 BCE:

£572,320 - £800,000 = -£227,680 (this is a negative figure)

The member’s LSA ‘ought to” then be reduced by 25% of this LTA previously used amount. But 25% of a negative figure -£227,680 is still a negative figure. £268,275 less -£56,920 (a negative figure) is £325,195, however – despite the validity of the mathematics here – it is our view that this calculation cannot result in the member having a LSA in excess of £268,275, so in this case the member’s LSA is indeed £268,275.

We take this view because Section 637Q of the Income Tax (Earnings and Pensions) Act 2003 – which allows for various ‘transitional provisions’ (such as the special treatment of age 75 BCEs) to affect the level of a member’s LSA - only permits those transitional provisions to serve to reduce the member’s LSA. As such, we would take the view that there is no scope for those provisions to increase the LSA.”

Hello? Are you still there? Hello…..?