What independent wealth looks like

by Doug Brodie

/1. How the wealthy – very wealthy – spend their money.

Confession time: the garden is my wife’s domain, and all things in it. A couple of years ago our garden shed was clearly defying gravity, so I decided to front run the inevitable collapse and replace it. Firstly, twenty years of accumulated items had to be removed, and in doing so I noticed our lawnmower was missing.

It was explained to me that we no longer needed one because we now had a gardener who brought his own, and who did a much more efficient job than we were able to plus … and this is the key point …. he gave us back our time, so that instead of a couple of hours per week in the flower beds etc, my wife now has time for all the other weekend activities.

We can’t buy happiness, and we can’t add extra time to our allocation, however we can make more efficient use of our current time by outsourcing the tasks we don’t want to do. Having a pool in the garden is a wonderful addition to use, maintenance of the pool through the year is completely different. More mundanely, cleaning windows is not really a technical challenge, but surely the window cleaner is a luxury everyone should be able to afford. The development of white goods in the post war 50’s industrial and consumer boom was signalled as the development of labour-saving devices, and it is well recorded in economic journals that that altered the gender make-up of the workforce.

You and I might hire a gardener or window cleaner, even an au pair in days gone by, take a wander along any corniche and you’re unlikely to find those of material wealth popping into Aldi, filling up the Rolls at the petrol station, taking the rubbish bags off the yacht or changing the light bulbs at the entrance to the driveway. The true display of wealth is surely having staff, help, employees, it’s not the diamond earrings: the former will give you free leisure time, the latter will sit in a safe for 99% of your ownership. (Though I am partial to pink sapphires…)

/2. The £XXXk pension mistake most people never spot.

Here’s a stat that should blow your mind: over £100 billion of pension wealth in the UK is languishing in zombie accounts — unloved, unmonitored, and often invested in underperforming funds.

And yet, most people we speak to think “it’s all sorted”.

Here’s the kicker: if you’ve had just 3–4 jobs over your career, chances are you’ve got a pension pot or two that’s:

still charging 1–2% fees (often hidden)

missing out on better investment options

not aligned with your life goals — or even your risk profile

And if you’re self-employed or exited a business? Even more likely no one’s optimising anything.

This isn’t about “retirement planning”. It’s about personal capital strategy — making sure your past income keeps working hard for your future freedom.

At Chancery Lane, we don’t “manage wealth”, we start by designing it. With proper thinking around tax wrappers, family legacies, business exits and, yes, those dusty old pensions too.

Little-known fact: If your pension is invested in a lifestyle fund, it might be automatically moving into bonds too early — quietly costing you tens of thousands over the years. Regular readers of this newsletter saw an example of this six months ago where we were approached by someone who had lost 25% of her pension just this way.

It’s easy to fix. But only if you know where to look.

/3. Personal wealth – not about picking funds.

As Buffett later highlighted in a celebrated 1984 speech, even relying on fund managers with an exemplary track record is often a fallacy. He imagined a national coin-flipping contest of 225 million Americans, all of whom would wager a dollar on guessing the outcome. Each day the losers drop out, and the stakes would then build up for the following morning.

Purely as a matter of statistics, after ten days there would be about 220,000 Americans who have correctly predicted ten flips in a row, making them over $1,000. Now this group will probably start getting a little puffed up about this, human nature being what it is. They may try to be modest, but at cocktail parties they will occasionally admit to attractive members of the opposite sex what their technique is, and what marvellous insights they bring to the field of flipping.

Here’s something most people never get told: personal wealth isn’t about picking funds or “saving harder”. It’s about structure, strategy, and knowing a few rules the system doesn’t advertise.

Some facts worth your time:

Additional-rate taxpayers can claim back up to 45% in tax relief on pension contributions — but over 80% never do it properly.

Most people in their 40s and 50s have pension pots scattered across 4–6 providers, with no clear investment strategy and excessive fees hidden in the fine print.

If your ISA is sitting in cash or a default fund, inflation could be silently eroding its value every single month — by more than 20% over a decade.

You can use your pension to buy commercial property — even your own company’s premises — yet very few entrepreneurs know this is an option.

If your estate is over £1m (including your home), Inheritance Tax could eat 40% of your children’s future wealth. With the right structures, you could bring that down to near-zero — completely legally.

We see this all the time: smart people doing great things… but their personal capital is sleepwalking.

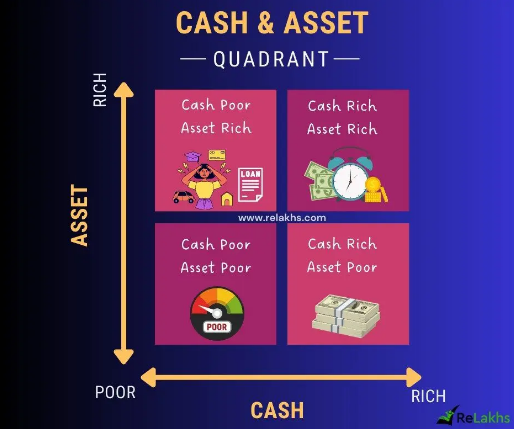

Here, we bring clarity, control and intelligent design to your wealth. We do the spreadsheets; you get the freedom. Income does not equal wealth – Mr Micawber was right, and we do see a good number of people living in enviable properties who come to us for retirement income expertise, and we discover there is still a large mortgage outstanding.

And plenty of professionals earning £150k+ still hit 50 with little more than a house and a pension pot they’ve never checked.

Let’s break the pattern. Some facts most people rarely pay attention to:

The marginal tax rate for many professionals is over 60% once you cross £100k (thanks to the Personal Allowance taper). Most don’t realise how to strategically reduce it.

Investing via a limited company can open up serious tax efficiency, from pension contributions to dividend planning.

Your employer pension is great — but did you know you can negotiate higher employer contributions as part of your package instead of a higher salary, or even redirect bonuses into pensions tax-free?

Many high-earning professionals hold too much in cash. Inflation is quietly draining 20–30% of their long-term value.

Using insurance wrappers, venture capital trusts, or family investment companies sounds exotic — but for the right person, it can change the trajectory of your wealth.

At Chancery Lane, we help professionals turn strong income into durable, strategic capital — without the overwhelm, jargon or cookie-cutter advice.

It’s not about being flashy. It’s about building freedom — with structure and intent.

/4. From the Wall Street Journal – how to choose a financial planner, or an adviser.

It’s quite common to go through your working life without taking advice from anyone about your financial life. It’s deeply personal, and many people – usually men – assume their financial balances at retirement are a score card. They’re not, and too often people fall down the rabbit hole of believing that everyone else has endless wealth. They don’t.

Many of your peers have inherited money.

Several of them may have been acutely overpaid for the work that they have done – with 1,320 working hours per year how do they earn £1m per year? Who’s paying on the other side?

Some get lucky, get a start with family support or get business handed to them or buy a property in just the right place before anyone knew.

Some accrue wealth accidentally (and believe they’re a genius).

Some have borrowed money on everything – a giant mortgage at retirement that they turn into an equity release as soon as they can (so they don’t actually own anything), car leases, everything purchased ‘on tick’.

Some even borrow from the bank to spend on expected inheritances.

Some are competent and hard working folk who do well, and invest wisely.

At retirement, however, if ever there was a time to double check on what you have and how you plan for the next thirty years, this is it.

What does a financial planner really do - and should you retain one?

In a world where anyone can call themselves a financial adviser, it’s no surprise that many professionals feel unsure about who to trust — or even where to start.

You might be wondering: Do I really need a financial adviser? What exactly do they do? And how can I tell if they’re legit? How do I ensure I won’t regret this?

Let’s have a look.

The job title means less than you think

The term financial adviser isn’t regulated in the UK or most other countries. That means almost anyone — from investment brokers to insurance reps — can use the title without meeting a fixed standard.

But in practice, a financial adviser is someone who helps you make smarter decisions about your money: planning, investing, saving, protecting, and sometimes even spending it. A good one helps you design your financial future with intention — not guesswork.

A regulated financial adviser is registered by the FCA and you can find their details, you can look them up here: https://register.fca.org.uk/s/

Not all advisers are equal: The Fiduciary Factor

Before diving into qualifications or services, ask one key question:

“Are you independent?”

Independent advisers are legally obligated to put your financial interests ahead of their own. Many “advisers” aren’t — especially if they’re earning commission from products they sell. An independent adviser is retained by you to act as your professional planner and adviser. If the adviser is not independent he/she is ‘tied’, which means they are employed or retained by a company to distribute and advise on ONLY their products.

The obvious example is St James Place, where advisers are only permitted to advise on an recommend St James Place products and funds. A Friends Life adviser can only advise of Friends Life products and funds.

That doesn’t make them bad. But it means their advice might be shaped more by incentives than by what’s best for you.

Always ask if they are independent in all areas.

How financial advisers are paid

Advisers are paid in different ways — and how they’re compensated can shape the advice you get.

Here are the most common fee structures:

Assets Under Management (AUM): A % of your investment portfolio (e.g. 1% of £500,000 = £5,000/year)

Flat fee or retainer: Fixed payments for ongoing support, regardless of portfolio size

Subscription model: Monthly or quarterly fees for access to advice or planning tools

Hourly rate: Pay for time used, ideal for one-off or specific questions

Commission: Payment from selling financial products (insurance, funds, etc.)

There’s no perfect structure — but you should understand exactly how they’re paid, and how that aligns with your interests.

Credentials that signal professionalism

While being independent matters most, certain designations show real expertise and training. These include:

CFP (Certified Financial Planner): Broad financial planning, investment, and tax expertise

CFA (Chartered Financial Analyst): Deep investment knowledge and portfolio management

Chartered Financial Planner: the top level of certification from the Chartered Insurance Institute.

Credentials aren’t everything — but they can give you peace of mind. There are two institutes covering this sector in the UK – the CISI (Chartered Institute for Securities and Investments) and the CII (Chartered Insurance Institute) -the top rungs in both of these, as with any professional institute, is fellowship.

How to choose the right adviser

Finding a good adviser isn’t just about qualifications — it’s about fit. Look for someone who:

Has experience and qualifications for the work you need done – if you need investment planning and research, make sure you talk to investment specialists.

Is clear about how they’re compensated

Offers services that match your needs (planning, investment, business, etc.)

Communicates clearly and listens well

Start with google. We don’t recommend you use any of the ‘find a planner’ sites, even with the institutes, because they have all been gamified – altered by people fudging their details so that, for example, wherever you happen to live in London, ‘Joe Bloggs Wealth’ always appears as your nearest and best option. Interview 2–3 advisers. Ask questions. Trust your instincts, work with someone who understands you, has experience in handling the planning you need, and who you’d happily spend time with.

Questions to ask before hiring

Are you independent?

Do you outsource your investment management, and your recommendations?

How are you compensated?

What does your fee include — and how often will we meet?

What experience do you have with clients like me?

What are your professional qualifications?

If in doubt, don’t. There’s nothing wrong with cash in the bank, and you need to ensure your next financial steps are in the right direction.

Final thoughts: Is a financial adviser worth it?

If you’re managing significant income, assets, or complexity — a good adviser isn’t a luxury. It’s a strategic partner. The right one can save you far more than they cost.

You’ve worked hard for your money. Make sure it’s working just as hard for you.

/5. Tax-smart income: minimizing HMRC’s share.

You work hard. You earn well. But if you’re not strategic, HMRC could be the biggest beneficiary of your efforts — and not in a warm, fuzzy, let’s-fund-the-NHS kind of way.

There’s a difference between paying your fair share and over-paying out of ignorance or inertia. Here’s how high earners and business owners can extract income with far more efficiency — and legally keep more of what’s theirs.

1. Use pension contributions to slash income tax

If you're earning over £100k, your personal allowance is being tapered, meaning your effective tax rate can quietly creep over 60%.

Pension contributions can fix that. Each £1 you contribute reduces your taxable income — and you get tax relief on top. For higher-rate taxpayers, that’s a 40–45% return, instantly.

For business owners: contributions made through your limited company are a corporation tax deduction too. Double win.

2. Take dividends, not salary (where sensible)

If you own a limited company, paying yourself mostly via dividends instead of salary can drastically reduce NI costs — for you and the company.

You still need to stay within the rules and plan around dividend tax bands. But done right, it’s one of the most efficient ways to draw income in the UK.

3. Use the right wrappers (ISAs, Bonds, and VCTs)

ISAs: Tax-free growth and withdrawals. Use them every year — or lose the allowance.

Investment bonds: Useful for high earners wanting to defer income or gift wealth.

VCTs and EIS: For the adventurous, these offer 30% tax relief upfront, tax-free growth, and more.

These aren't for everyone — but if you’re paying higher-rate tax and not using any of them, you’re likely bleeding capital unnecessarily.

4. Income shifting with your spouse or partner

Married or in a civil partnership? You might be able to redistribute income to the lower earner — especially if they’re under the higher-rate threshold.

Think dividends, rental income, capital gains. A few signatures and declarations, and you’re moving thousands from HMRC’s pocket back into your future.

5. Don't ignore corporation tax planning

If you run a business, timing matters. Bringing forward expenses, using the Annual Investment Allowance, or paying into pensions before year-end can reduce corporation tax immediately.

Also: are you sitting on excess cash in your business? That’s an opportunity for corporate investing, pensions, or even buying commercial property through your pension. (Yes, really.)

Final thoughts

We’re not talking about loopholes or tax dodges. We’re talking about using the rules intelligently — because they’re there to be used.

HMRC will happily take more than their share if you let them. But you don’t need to.