Racing against me

by Doug Brodie

/1. Gertcha!

Photo of Alex Lau.

Remember National Geographic? You do, and the ability to get completely lost for 45 minutes in the stunning photos and stories of other people in other lands. Well, Nora is in Detroit, and I’ll bet her life is pretty alien to most of us here. The magazine has just run a fabulous story, brilliantly written by Chris Ballard, on the beneficial effects of exercise on our aging bodies. He writes of Nora, an estate agent:

“In her world, effort had always mattered. And yet here she was, struggling to make it to the second floor while showing houses to potential buyers.

She began to worry. She’d seen retirees fall prey to a sedentary lifestyle. “Ten years later, they’re gone because they don’t do anything but go home and eat, eat, sit down, and look at the TV,” she says. “I saw a lot of my friends pass away because they weren’t strong enough.” She wanted no part of it. “I said, No, I’m not going out like that.”

The long and the short of it was she met a trainer who was the husband of a friend and he gave a short training session using nothing other than a broom handle; everything has to start with a start. Remember Chrissie Wellington told us she just starts with putting on her shoes. Grace Chambers has done 250 Parkruns, slowly, and she’s 97. John Day has completed 500 and he’s 93 – it’s not the time, that is a) irrelevant, and b) used as an excuse way too often. When people complain about their knees, they can still get around a supermarket, and potter around the house/flat/estate.

Last weekend I ran in the Regents Park 10k, a monthly race, all year round. Ed Curtis is in his early 20s and came in first in 34 minutes – that is really quick. Mark Hamsher, though, came in the last position, with a time of one hour and twenty-five minutes. Mark is in his 70s, I watched him run his last 50 yards wobbling across the path, but he would not miss it for the world. “What else would I do?” He finished, everyone clapped and cheered, long after we’d all forgotten about the skinny guy who’d come in first and was probably by then at home, showered and having breakfast.

There are many reasons for avoiding a healthy lifestyle, just not many excuses.

And this person beat me.

Last word goes to Chris Ballard:

“A 2024 longitudinal study in Circulation found that logging 300 minutes of moderate weekly exercise, or 150 minutes of intense activity, can lower mortality risk by roughly 30 percent. By another measure….

…every minute you exercise adds five minutes to your life.”

/2. Are you rich? Êtes-vous riche?

We have think tanks here – they do politics, child poverty, health, etc. France has l’Observatoire des Inegalités; well, they would, wouldn’t they?

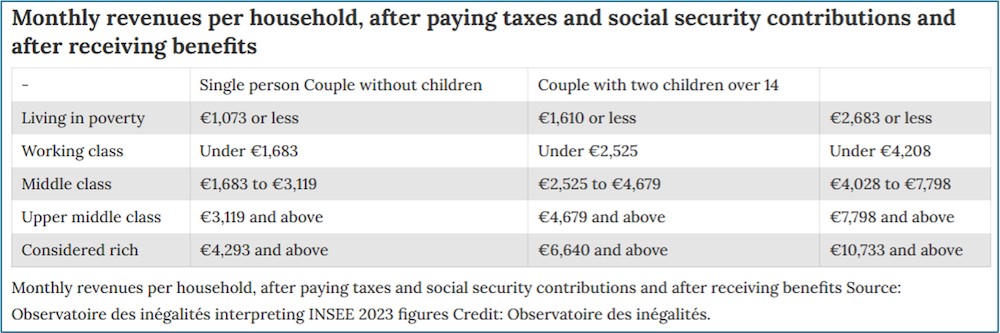

Interestingly, new estimates on what it means to be “rich” in France have been published by the statistics-focused think tank, reviving debate over how to pin down a term that is inherently subjective but frequently invoked in political arguments. According to the report, a married couple with no children falls into the “rich” bracket if their disposable income—after taxes and social contributions, and including any benefits—reaches €6,440 per month or more. For a couple with two children aged over 14, the threshold climbs to €10,733.

The study also sets out the lower end of the spectrum. A couple without children is classed as “poor” if their monthly disposable income is €1,610 or less. For a couple with two children over 14, that figure rises to €2,683.

Funded through private donations, the Observatoire des Inégalités aims to make sense of social inequality in France, examining income, class, and related factors such as geography.

Its effort to put objective markers on a widely contested label comes at a tense political moment, with both far-left and far-right parties framing higher taxes on “the rich” as a remedy for France’s fiscal pressures.

Even so, disagreement persists over what “rich” should capture: income alone, or broader measures of accumulated wealth. Maybe the answer to your query of ‘Am I rich?’ simply depends on what country you are standing in when you ask that question. The online magazine connexionfrance.com has published this table for us:

So if your monthly income, after tax et al, is £9,371, then the French class you as rich. That’s £112,452 net per year, a fairly healthy net income for most folk. The fascinating thing to note is that the French define wealth by income, not by assets. Just as Jane Austen’s Mr Darcy was deemed exceedingly wealthy with an income of £10,000 per year, whereas Mr Bingley was merely ‘wealthy’ at £5,000 per year, and the Bennetts could keep their family of seven, along with servants, on a moderate £2,000 per year.

/3. It's getting hard to tell gambling from investing

This time it’s an article in Bloomberg that parked our attention; further into this article, the author writes about a company called Jane Street – it is a quant investor, it uses algorithms and mathematical strategies to calculate and place derivative bets on markets. Jane Street is so successful that in the third quarter it generated $7 billion in revenue and its dominance of market investing led to it being from trading the options markets in India.

This is different to the fixed income arbitrage group at Salomon Brothers, who were famous in the 80s for betting with each other on the eight-digit serial numbers on dollar bills (Liar’s Poker).

/4. Looking at a trust: Temple Bar

In 2020, it all went horribly wrong. The trust was founded 99 years ago, in 1926, as the Telephone and General Trust, operating as a subsidiary of the Automatic Telephone and Electric Company, primarily arranging credit facilities for the parent company’s exports. The name was changed to Temple Bar in 1977. In 2020, it was dented by the covid pandemic, not least because its top position was in easyJet!

What ‘horribly wrong’ means.

The manager was changed by the board, with Investec being replaced by Redwheel, all the borrowing/gearing was closed and repaid, and the dividend was cut by 25%.

The dividend was maintained at 75% of the previous level.

In 2019, the income for the trust was £39.8 million, which then fell by 68% to £12.7 million – ouch. However, the dividend paid to shareholders fell by just 25% because it started 2020 with £37 million in revenue reserves. The story here is not the resilience of the income, but what the team at Redwheel has done with the capital:

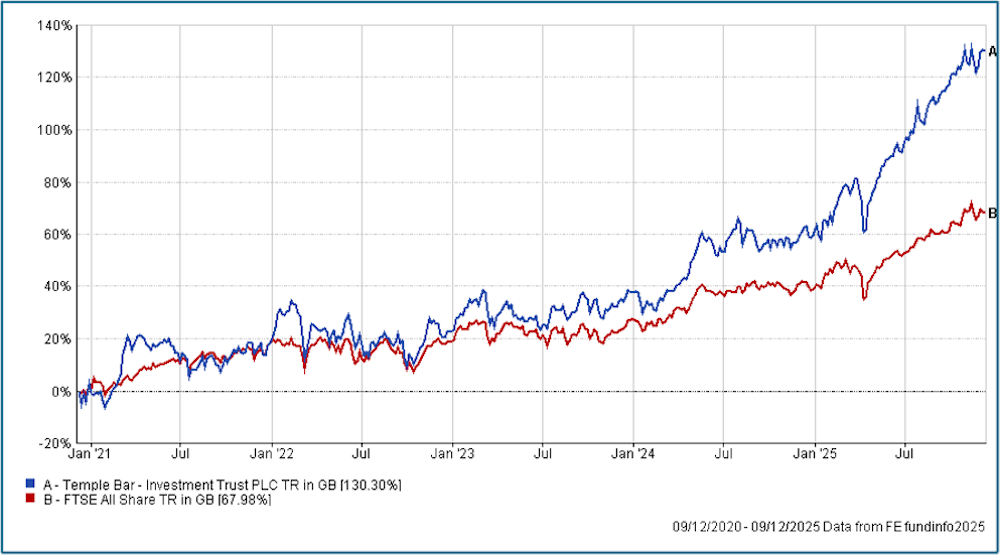

“In its first five years under Redwheel, the £1bn trust has delivered a share price total return of 221% − more than doubling the 98.6% gain made by the FTSE All Share and thrashing the 89.4% return made by its peers in the Association of Investment Companies’ UK Equity Income sector.”

Over the last five years:

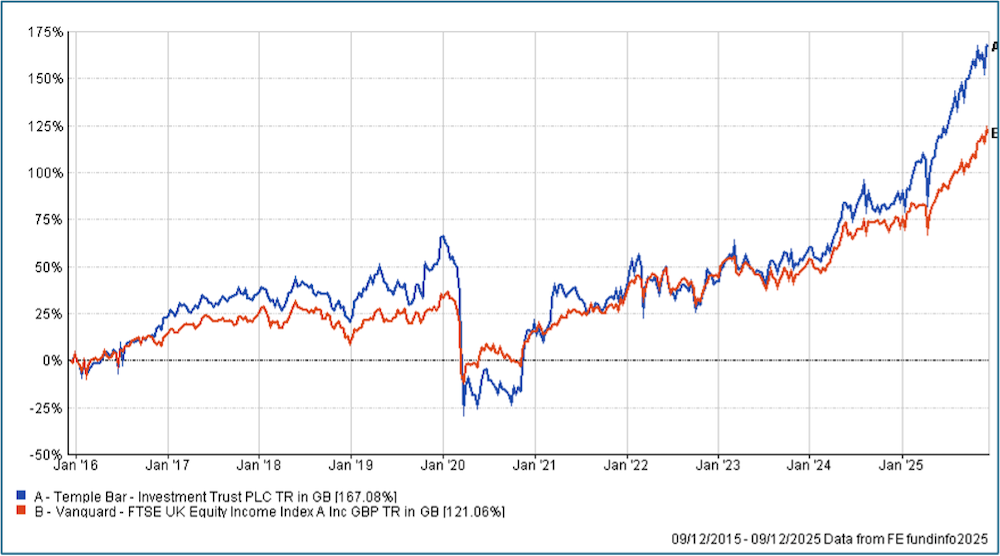

Over the last ten years:

Of course, the common argument is that in a rising tide all boats float, so comparing this trust to Vanguard’s UK Equity Income Index shows if there is a ‘value add’ over and above the market:

Temple Bar has an annual management charge of 0.35% which is more than Vanguard’s charge of 0.14% but the stark proof is in the performance. This isn’t the whole story, however, because in addition to the annual performance for the 0.35% you also get a share of Temple Bar’s current £15m revenue reserve and £688 million capital reserve.

/5. This is important if you want to be relaxed

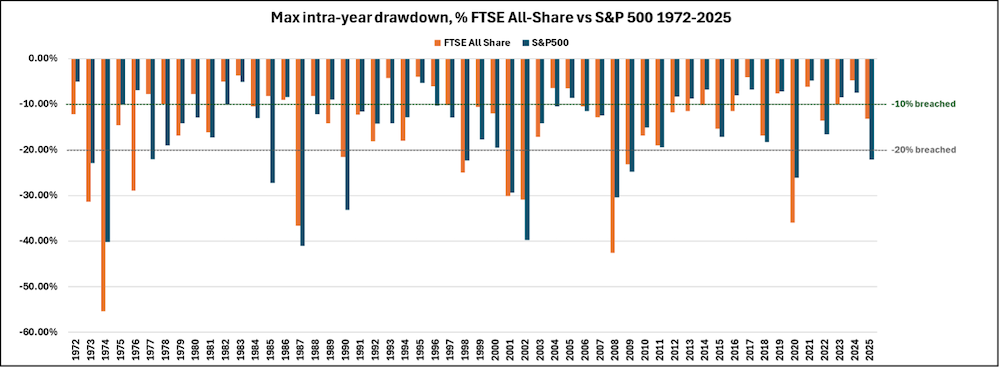

You probably look at investment returns based on the headline figure for a year, so in 2024 the FTSE index returned 5.69%. That’s not the story, though. During the calendar years, all markets will rise and fall from day to day, and investors’ emotions will trigger a dry mouth when they think it’s all going to go just one way. It isn’t, just as it’s not always going to go up (“Yeah, I know that..”), it’s also not going to go down (”Yes, but …”).

The chart above shows the biggest intra-year falls, it measures the steepest fall within the year from a peak to a trough, and you can see that although the FTSE returned 5.69% between January and December, in the middle of the year it fell by -4.76%. Obviously, it then recovered. Unless you’re a short-term trader, such movements are really unimportant; focusing on them will make an investor panic and lose the ability to think rationally.

/6. Annuity rates at 9th December

If you’re married and want an RPI increase, at 65 the rate is 4.46%, compared to at 60 it’s 3.99%. That’s interesting because you can get 4.02% in the current 5-year gilt yield, so buy that if you’re 60, get your capital at 65 and then consider the annuity when you’re five years older.