Special, you are so special

by Doug Brodie

Buffett on gold

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

The price of gold is not the last traded price, like bonds and equities; it used to be set by the collusion of five banks, however, a new system was designed to provide greater regulation and transparency after a scandal was uncovered in which banks were found to have been rigging the gold price for their own benefit – setting the gold price is known as ‘the fix’. Hmmm.

“It is now set electronically, administrated by ICE Benchmark Administration Ltd (IBA), the leading provider of regulated benchmarks for numerous international financial and commodity exchanges.

The LBMA Gold Price is still set twice a day, based on the price set in auctions at 10:30 and 15:00 GMT.

The auctions allow buyers and sellers to trade physical gold, and are played out in rounds of 45 seconds. IBA announces a price at the start of each round, for which bidders will then submit their buying and selling proposals. After each round, the difference between the proposed buying and selling volumes is calculated. If this difference is lower than 20,000 ounces, the auction ends and the LBMA Gold Price is set. However, if the difference is larger than 20,000 IBA announce a new price and a new auction round begins.”

The budget – will she, won’t she?

The most common query currently being emailed to us is whether Ms Reeves will go after tax free cash from pensions.

This is our reply to a client who also had Fixed Protection on his SIPP:

“There’s nothing like a tax rumour for the media to fire up its clickbait headlines; professionally we don’t know, there is no commentary from the Treasury or HMRC. However…who knows?

I think the relevant answers are don’t know / maybe / we’ll have to wait.

As a chancellor who may be somewhat out of her professional depth in a government that painted itself into a corner before it started, anything could happen. Maybe dropping a tax bomb is what she needs to do? If so, people will simply leave their pensions in situ and not crystallise anything.

It would be remarkably harsh and very unpopular to do anything endangering the current PCLS. When the government changed the LTA they went out of their way to protect ‘pension protections’ such as yours, so I do not think that will be touched. They might/could/maybe announce a change to PCLS max in future years, ie. for those retiring in 10 years’ time, just not for those who have immediate plans for imminent withdrawals.

She’ll make much more, quicker cash by scrapping the triple lock on state pensions and by hacking the pension premium tax relief - there’s been no rumours on that, which is unusual, so that could be what she’s planning - it used to be front and foremost in the rumour mill, and is notable by its absence because it gives her immediate cash. Capping tax relief at 30% - why not?

I can’t see why she would do anything to existing schemes for near retirement people because it’ll bring in such low amounts of tax revenue, and it’ll hit everyone – including union members and all the civil servants. All that would happen is people wouldn’t draw PCLS until absolutely necessary, and it’s the people with the smaller pots who need it most – for paying off debts, mortgages etc. It won’t touch the sides of the black hole. The more effective way of raising large sums of immediate cash is to cut tax relief on premiums – that’s what I would do, and I wonder if the tax free cash rumours are a red herring.

Do you need the tax free cash, and if the max sum you could draw tax free was reduced would that impact your standard of living or simply be an annoyance?

If you are concerned then back both horses - take half out.

If you want certainty then take it all out - what’s the downside?

We’ll see. I’m sitting on my hands with my own SIPP – I don’t actually need the money now and I don’t like trying to second guess tax.”

China and involution – bigger may be a lot more dangerous.

“Involution: China is trapped in a cycle of competition so fierce that it is destroying profits, driving a brutal rat race among workers and fueling a deflationary spiral.

This is “involution,” a once esoteric term that has come to define life for many in China and capture the problems in the world’s second-largest economy. Involution, simply stated, means that, even as China pursues global dominance in industries of the future - AI, renewables, robotics - much of its economy is in a race to the bottom that threatens to devolve into widespread stagnation.”

The Economist.

China has commoditised car manufacturing: it used to be in the 70’s, 80’s 90’s that Japanese cars were known to be reliable, and at the same time recognised as always bland and boring – they did nothing for aesthetics. Now this:

is made by the same company that I noticed builds this:

When you and I were sprogs the label ‘Made in Hong Kong’ stood for cheap, plastic rubbish, but no longer. However intense internal competition by the Chinese firms, most of whom we have never heard of, means prices are being slashed, leading the industry into involution, the Chinese term being “neijuan”, being economic stagnation created by increasing effort. Speeding up towards a brick wall?

The more they build, the more they get stacked up. It used to be that grubby-shirted boys could tell a Hillman Minx by its rear fin, or a Morris 1100 by its wing mirror – now, computer aided design has made it impossible to determine British design elegance from Chinese software output.

One way to retire with friends

The New York Times published a recent article on shared retirement, an innovation inevitably from socially-minded women

The Bird's Nest is a tiny-home retirement community in East Texas founded in 2022 by Robyn Yerian, a 70-year-old divorced woman seeking an affordable retirement solution. The community houses 11 women, mostly single, who live in customized 300-square-foot homes for just $450 monthly rent.

Yerian created the community to address common retirement challenges - many single working women have insufficient savings (64% have less than $50,000 saved). She bought cheap land and built a space where "women empower women," offering both affordability and community.

The residents come from diverse backgrounds across the U.S., with varying political and religious views. Despite their differences, they maintain harmony through a "no drama" philosophy. They collectively maintain the property, planting gardens and handling maintenance themselves.

The community demonstrates how retirement friendships can form differently than earlier life bonds. Rather than trying to coordinate retirement with existing friends (who have different timelines and circumstances), The Bird's Nest shows the value of finding like-minded people seeking similar living arrangements. The women describe forming "instant friends" and "best friends at 65," creating the combination many seek in retirement: independence with mutual support, affordability with community, and privacy with friendship.

The best known example of this is actually in Europe, it’s the collective housing project in Midgaard, Copenhagen: always community on hand, individual apartments and shared spaces when wanted. An exceptionally strong focus on community - when the four biggest fears of older adults are 1) fear of dying alone, 2) concerns about death, 3) fear of being a burden and 4) loss of purpose and meaning.

Gordon Brown, and now Ms Reeves?

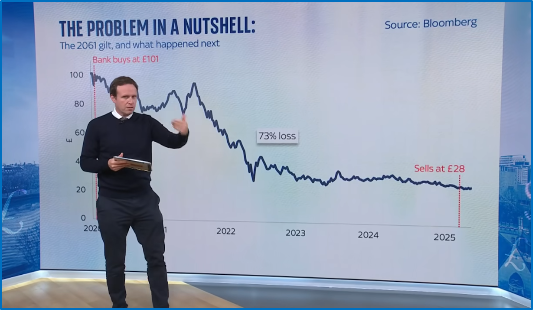

Gordon Brown studied history at university then worked in a further education college and as a tv journalist so perhaps it’s no wonder he got ‘Buy low sell high’ the wrong way round:

Gold is now over $4,000 by the way.

During QE, gilts (borrowing) were issued by the Treasury and the Bank of England stepped in to buy them up to keep active buying pressing down on interest rates. It got fat on gilts, so now the bank is selling them off. The trouble is, as interest rates have climbed, so the capital value of gilts is the inverse. This picture says it all: this is Ed Conway, economics editor of Sky News, explaining that the 2061 gilt was bought at £101 and now been sold at £28.

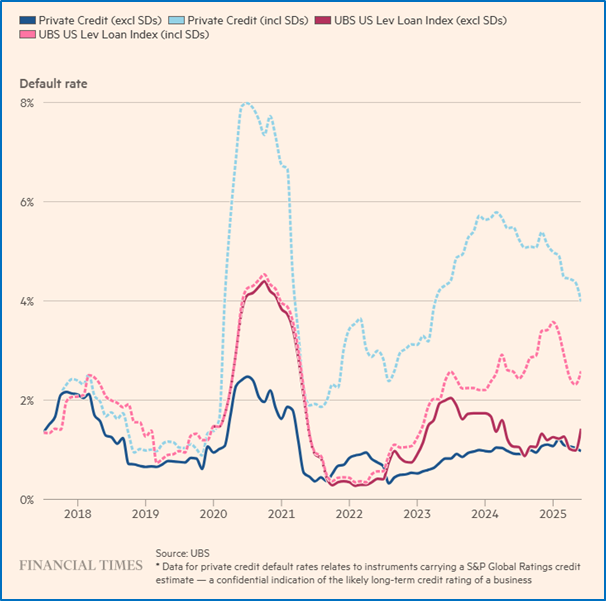

“Private credit defaults” – cockroaches? It’s US sub prime again

This is a great chart from the FT; private credit is just another term for ‘lending but not from banks’.

Companies in the US are going bust, big time:

“When you see one cockroach, there are probably more,” Jamie Dimon, the JPMorgan Chase CEO, ominously cautioned analysts this week, after the US’s largest bank disclosed a $170m charge tied to Tricolor’s bankruptcy. “Everyone should be forewarned on this one.”

Tricolor was a used car seller and (wait for it) sub-prime auto lender. “The average monthly repayment now stands at more than $750 (£565). Car repossessions surged to their highest level since 2009 last year, according to Cox, with 1.73m vehicles seized, up 16% from the year prior and 43% from 2022.” Barclays got hit for £110m on this company – why?? First Brands, a maker of wiper blades and spark plugs et al, has gone bust owing between $10 - $50bn, of which $2.3bn has ‘simply vanished’. Either the staff in the lenders weren’t very bright or they were getting paid serious money in making those loans – you choose the answer.

Perfect dip buying.

The maths was in last week’s blog, however this image is the perfect summary.

Remember, you can’t know the bottom of the dip until after it has passed, so technically it’s not possible to plan investing around this – the figures below are theoretical, not achievable. And 0.4% per year is often the difference in just one day’s trading.

The market crash: it’s coming, read this.

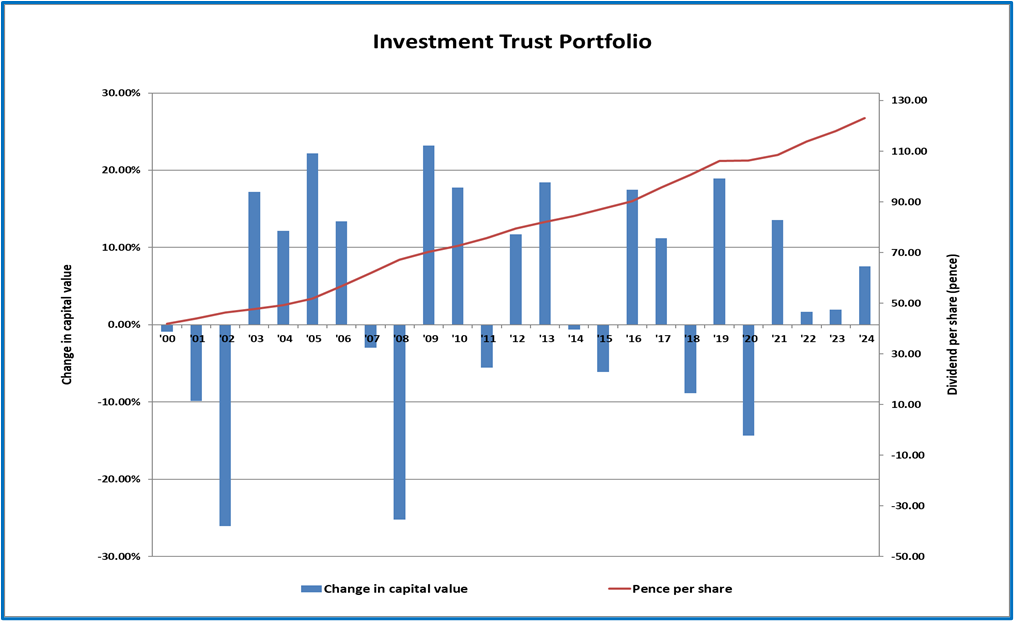

Investment income and investment capital prices are not correlated.

The blue bars represent the share prices of a simple portfolio of six investment trusts and you can see them dutifully following the market down in 2000, 2008, 2020 etc. The red line is the income and that increases every year, including when the markets crash. It’s not smoke and mirrors, it’s because the income is paid from reserves and NOT from the shares.

There will be a major US correction (it’s cyclical) and the UK market will get whiplash – don’t touch your income portfolio, your income will not fall. The biggest risk to your retirement income is you making an emotional reaction. You cannot control external events, so controlling your reaction to them is grounded in expectations, and those in turn are based on understanding the likely steps/actions/elemants that will occur.

Simple.

Tariffs – things ain’t what they seem

US puts tariffs on China, China stops buying soyabeans from the US.

The US puts together c$20bn bailout funding for Argentina – who knew? Why?

China switches its soyabean buying from the US to… Argentina.

Argentina receives foreign currency from… China.

Getting your head around your age

"If you're 37... Instead of regretting that you can't wake up age 18 again, pretend to yourself that you're 90 and you've woken up age 37 again, and that you get to magically, wonderfully have the next 50 years again. If you’re 65, in fifteen years’ time you’ll wish you are the age you are today."

Age is a number, so if you’re not happy with yours just fake it, it’ll keep you happy. After all there’s always Natalie Grabow (What’s your excuse? I’m still trying to work out mine):

The bit of your wealth that’s missing.

You know the value of your SIPP, ISA and perhaps GIA and other investments, however most people ignore the value of the £11,973 per income stream they will/do receive. In investment terms it would never be ignored, so taking it into account has an impact on your overall asset allocation – it is a finite and can-be-valued sum of inflation-proofed, guaranteed fixed income.

Take 26 years of payment (hey, I’m always an optimist when it comes to life), this is how to value your state pension from an asset perspective:

To calculate the present value of £11,973 per year growing at 2.5% annually for 26 years, we need to choose a relevant discount rate (the rate of return you could earn on alternative investments or the interest rate used to discount future cash flows).

The present value of a growing annuity uses this formula:

PV = P × [(1 - ((1+g)/(1+r))^n) / (r-g)]

Where:

P = initial payment (£11,973)

g = growth rate (2.5%)

r = discount rate (needed)

n = number of years (26)

Common choices for a discount rate on government backed, inflation proofed securities might be:

The current risk-free rate (e.g., government bond yields)

Expected investment return rate

A specific interest rate relevant to your situation/country

By way of example, if the discount rate were 5%, the present value would be approximately £237,445. But the actual value will vary significantly based on the discount rate chosen. However, the yield on the 26-year index linked gilt is 2.41% and is much the better comparative – that as a discount rate makes your state pension worth £306,749.

And for the maths and the bored:

1. (1+g)/(1+r) = 1.025/1.0241 = 1.000878

2. (1.000878)^26 = 1.02306

3. 1 - 1.02306 = -0.02306

4. -0.02306 / (0.0241 - 0.025) = -0.02306 / (-0.0009) = 25.62

5. £11,973 × 25.62 = £306,749

There you go, you’re richer than you thought.

Avoid the folly of the crowd

“If you don’t work hard at trying to remain rational and you’re constantly floating along caring terribly about what other people think, you’re almost sure to be carried to folly by the folly of the crowd. And you can be sure that there will always be folly of the crowd.”