Coke is it: Buffett’s $11.7bn income from $1.3bn investment.

by Doug Brodie

Things Go Better with Coke

Warren Buffett's Coca Cola Lesson — Updated October 2025

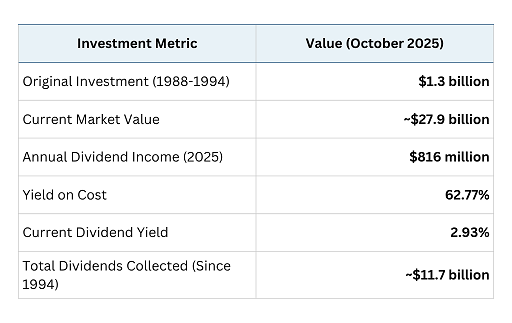

In 1988, Warren Buffett made one of the most legendary investments in history. Following the 1987 stock market crash, he invested $592,540,000 in Coca-Cola, quickly increasing his position to $1.3 billion by 1994, ultimately acquiring 400 million shares. Without unpicking Berkshire Hathaway's accounts, the average price he paid, adjusting for numerous stock splits, was around $3.25 per share.

Today, those 400 million shares represent 9.3% of Coca-Cola, and the investment has become one of the greatest dividend success stories in corporate history. As of October 2025, Berkshire Hathaway receives $816 million annually in dividends from Coca-Cola — that's $204 million every quarter, or approximately $2.23 million every single day.

A Dividend King's Remarkable Track Record

Coca-Cola's dividend history is nothing short of extraordinary:

The company has paid a quarterly dividend since 1920, without fail - over 100 years of continuous payments

Through every major crisis - the 1929 crash (sales up 13%, profit up 25%), World War II, Vietnam, the oil crisis, 1987 Black Monday, the tech crash, 2008 financial crisis, COVID-19 pandemic, and beyond - Coca-Cola never missed a payment

In February 2025, Coca-Cola announced its 63rd consecutive annual dividend increase, raising the quarterly payout by 5.2% from 48.5 cents to 51 cents per share

The annual dividend for 2025 stands at $2.04 per share, up from $1.94 in 2024

Recent five-year annual dividend increases: 2.4%, 2.6%, 5.4%, 5.7%, 6.1%, and 5.2% (2025)

The Power of Patient Capital - 2025 Update

The returns from Buffett's Coca-Cola investment have reached staggering proportions. Here's where the investment stands as of October 2025:

Annual dividend income: $816 million - that's a 62.77% yield on cost

Berkshire recovers its entire $1.3 billion investment every 1.6 years through dividends alone

Current value of holdings: approximately $27.9 billion (at ~$69.70 per share as of October 2025)

Total return: Over 2,046% gain on the original investment, not including reinvested dividends

Since 1994, Berkshire has collected over $11.7 billion in total dividends from Coca-Cola

Daily dividend income breakdown: $93,150 per hour, $1,552 per minute, or $25.87 every second

Breaking Down the Numbers

To put these numbers in perspective, Warren Buffett's Coca-Cola investment now generates more income every single hour ($93,150) than the median American household earns in an entire year. The quarterly dividend check of $204 million is larger than most companies' annual profits.

The Magic of Dividend Compounding

Q: Once Coca-Cola had repaid the $1.3 billion investment through dividends, what then is Berkshire Hathaway's yield to their investment cost?

A: Since Coca-Cola has already paid back the entire investment multiple times over through dividends alone, Berkshire's shares are effectively held at zero cost basis. Every dividend payment is now pure profit - an infinite return on the original investment. The $816 million annual dividend is essentially free money, funded entirely by Coca-Cola's past dividend payments.

Not Just Coca-Cola - Berkshire's Dividend Empire

While Coca-Cola is an impressive dividend generator, it's not even Buffett's largest dividend payer. In 2025, Berkshire Hathaway's top dividend-paying holdings are expected to generate:

Chevron: ~$773 million annually

Coca-Cola: $816 million annually

American Express: ~$425 million annually

Apple: ~$300 million annually

Total from top holdings: Over $3 billion in annual dividend income

Why Warren Buffett Never Sells

Many investors have questioned why Buffett didn't sell Coca-Cola at various peaks, particularly during the late 1990s bubble when the stock reached extreme valuations. The answer lies in the power of dividend compounding and tax efficiency:

Tax advantages: As a corporation, Berkshire Hathaway benefits from the dividend received deduction, paying lower taxes on dividends than on capital gains

Perpetual income: The $816 million annual dividend stream continues forever without selling a single share

Compounding power: The dividend income is reinvested into other opportunities, creating a snowball effect

Market position: Selling 400 million shares (9.3% of the company) would significantly impact the stock price

Looking Ahead: The Next Decade

Despite challenges from changing consumer preferences and economic headwinds, Coca-Cola continues to demonstrate resilience:

The company expects organic revenue growth of 5-6% in 2025

Free cash flow is projected to reach $9.5 billion in 2025

The 63-year dividend growth streak positions Coca-Cola among an elite group of just 55 "Dividend Kings"

At the current growth rate, projections suggest that by 2035, Berkshire's annual dividend from Coca-Cola could exceed the entire original investment amount

The Investment Lesson

Warren Buffett's Coca-Cola investment exemplifies the extraordinary power of patient, long-term investing in quality dividend-paying companies. What started as a $1.3 billion investment has generated over $11.7 billion in dividends and grown to nearly $28 billion in market value.

For individual investors, the lesson is clear: finding companies with durable competitive advantages, strong cash flows, and consistent dividend growth can create wealth that lasts for generations. While we may not have Buffett's billions to invest, the principle remains the same - time in the market beats timing the market.

As Buffett himself has said, "Our favorite holding period is forever." With Coca-Cola generating $93,150 every hour for Berkshire Hathaway, it's easy to see why.

Would you like some?

Updated October 2025

Based on publicly available data and SEC filings