Why men need HRT

by Doug Brodie

/1. No commission or ketchup: be a customer not the product.

(Watch out for PFOFs)

That’s how they do an ‘authentic’ hot dog in Chicago; asking them to hold the ketchup doesn’t cut the mustard (apologies, Ed.) There is no ketchup on a Chicago hot dog.

The London tube has sprouted adverts from various new, usually American, companies offering investments with ‘no commission’. But there is no commission on retail investments, hasn’t been since the start of 2013, following the Retail Distribution Review by the FCA that concluded that commission in investments was not a ‘good thing’. It’s a bit like advertising Hine XO with ‘no added sugar’.

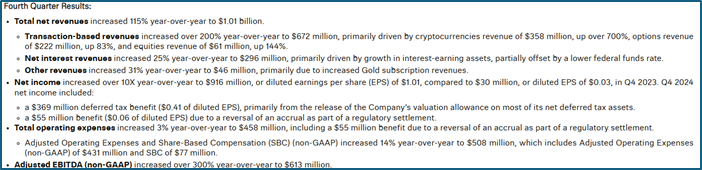

Robinhood is different and so are all the ‘free’ investment platforms. Robinhood grew its revenue by 115% in the last 3 months of 2024 to $1.01 billion, with a quite staggering $613 million in EBITDA (call it gross profit). In a quarter:

It makes its money on the spreads – the difference between what they buy a stock for, and what you pay. A PFOF is a ‘payment for order flow’ – to you and me it’s a kickback from the institutional market maker to the order platform (like the ‘hood) – the retail investor pays because he/she pays, say, 76p for a share that the market maker gets for 74p. The 2p difference is profit for both the market maker and the platform.

As share prices move 60 seconds of every trading minute it’s impossible for the retail investor to spot and measure. The bid/ask spread is the published price (we sell at 65p, we buy at 63p), however that doesn’t apply everywhere. Commission-free foreign currency exchange? You’re getting stitched up in the exchange rate. As I write, the Post Office is offering 1.0967 euros for a £1, whilst Wise offers 1.15 euros and Bloomberg tells me the general institutional rate is 1.1525.

The Post Office is getting the 1.1525 from the City, it’s keeping 0.0558 for its own profit, but

“It’s commission free, innit!”

/2. Fidelity’s Magellan Fund, 29.2% annual return from 1977 to 1990 (from $20m to $14bn) [Ed: when a $billion was a LOT of money]

If you were in Argentina during that time and inflation was running at 500% then relatively speaking you might not be impressed, however Peter Lynch turned in the almost 30% annual return whilst the S&P 500 returned 14.47%, so he beat it by more than double.

Not only that, $10k invested in the Magellan fund in 1977 grew to $280,000 by 1990, compared to the same investment in the S&P turning up $36,000 – an outperformance of 8x. If you want to get technical about his returns, a 3-factor regression model showed he was adding 0.78% per month over and above the expected market return, and that was calculated at 0.0000007% chance of that outperformance being random.

He would hold over 1,000 stocks in his fund, so it wasn’t outperformance through a small number of tech or IT or oil stocks. Clearly Peter Lynch’s expertise lay in avoiding losers, finessing the stocks he bought and letting the market do the rest. He managed the fund for 156 months and beat the S&P in 97 of those months. A bit like Roger Federer only needing to win 54% of the points he played, yet he won over 80% of his matches:

“But if you approach it with the mindset of ‘I must get every single point,’ you’re likely to have a mental breakdown or find it hard to adjust after major mistakes. I have a high school classmate who, during school, was only slightly better than the worst students.

Now, he is not only the academic leader in his field but also one of the major shareholders of a listed company. He was fond of football in high school and was one of the members of the grade team. He said that what he learned from sports was far more helpful to him than academic knowledge.

He knew early on that winning and losing were the norm, getting one’s feet dirty in the mud was the norm, and fighting to the end but being defeated by the opponent was also the norm. Unfortunately, most people didn’t receive any enlightenment education about success and failure when they were young.”

Dipsy Dai @medium

Peter Lynch retired in 1990 when he was 49, to spend more time with his growing family: wasn’t that the point?

/3. What to expect: outsourcing your key income decisions.

A man came in to see us having read of our work in the papers; he spent most of his time in Jersey and had a property portfolio in the UK plus a property management company – all looked after by employees.

As it happens, he walked into the office slightly after 8am, I was the only person here and was in the kitchen making coffee, so he joined me and we had a kitchen meeting, chatting about why he’d popped in unannounced while we shared several more cups of coffee from our indefensibly expensive coffee machine. He has a large amount of cash in the bank, accrued over the years with virtually no interest, and he said ‘I want to invest £1/2 million’.

We talked about why – he’s a wealthy man, he lives in a tax haven, has a recurring income stream and all the assets he needs. He wanted to invest because he was bored and didn’t like to see no interest in his bank account. I pointed out that even if he had 10% interest it would make no difference to him whatsoever. From our perspective he needed no income, which is our specialisation, and without a reason to invest he would only be able to evaluate our work based on whether the investment went up or down. Well it would, that’s guaranteed, it’s the way markets work. I said we couldn’t help, however if he wanted to see the markets moving he should simply buy a FTSE or World tracker on a DIY platform and then watch – if that entertained him that would be fine, but there was no purpose to invest, no reason to apply risk to his capital, so no way for us to measure precisely what needed to be delivered and no way for him to assess if we had delivered as required.

Investment must always be for a purpose – if you want to invest for growth, what do you want that bigger sum for? To give away? To buy another house? A bigger (depreciating) car/boat/plane/bike? For fun?

Investing for income is a joy for us because it is finite and it has a purpose: both you and us can see what the target is and if/when that target is hit, and we want a bullseye every time. In truth, we have never missed – we can do that with annual income but no one can do that with annual growth.

Remember the days of Landsbanki, Glitnir and Kaupthing in 2008? Return of your money always trumps return on your money.

/4. This pension paid the beneficiaries for 135 years: how long do you need yours?

The pension Irene Triplett was receiving when she died in May 2020, was the beneficiaries pension from her father; he started drawing the pension in 1885, twenty years after the end of the American Civil War. It was his war pension, he joined the 26th North Carolina Infantry of the Confederate Army when he was 16. He then joined the Union army, and the pension was from there:

“His honourable discharge from that service qualified Triplett for a pension and, the records show, he began to receive that pension in March of 1907. He was, at that time, 60 years old, and he drew the pension until his death in 1938.

But he did something else in the meantime: after the death of his wife Mary, he married again in April of 1924, at the age of 78. His bride, Lydia Hall, was 28 years old. And sure as night follows day, the 1930 census shows the result: a daughter, Irene, three months old.

“Eight years old when her father died in 1938, so qualified for a child’s pension. Disabled throughout her lifetime, so qualifying for continued pension payments as an adult. And 90 years old this past Sunday, May 31, when she died in Wilkesboro of complications from surgery for injuries after a fall.”

Old Mose Triplett is the chap on the right.

Investing using income generating assets ensures pension capital is not spent - so no matter what ups and downs the markets produce the income will run, and run, and run, and run, and run ……